The ultimate session of Wall Avenue’s holiday-shortened buying and selling week will see the S&P 500 open just about smack in the course of the three,800 to 4,200 vary it’s inhabited for greater than three months. Dips maintain getting purchased and rips offered.

The excellent news for bulls is that the benchmark fairness index

SPX

stays up 4.5% for the yr and has gained 12.2% from the October trough.

Nevertheless that rebound relies on a story of incompatible outcomes, which finally could also be dangerous information for danger belongings, warns Blackrock.

However first, why the rally? The group at BlackRock Funding Institute Threat led by Jean Boivin, notes that belongings jumped at first of 2023 due to falling inflation, decrease power costs in Europe, China’s fast re-opening as COVID restrictions had been lifted, and what it phrases technical elements – i.e. many buyers had been overly bearishly positioned.

“But we predict the rally additionally displays hopes that the sharpest central financial institution coverage tightening in a long time can keep away from financial harm: development will probably be sustained even when charges keep increased, and inflation will drop to 2% targets. Central banks then wouldn’t have to additional tighten coverage and create recessions to decrease inflation,” says BlackRock.

The inventory market seems, principally, to nonetheless imagine this. But 2-year Treasury yields

BX:TMUBMUSD02Y,

that are significantly delicate to Federal Reserve financial coverage, sit close to their highest since 2007, having jumped practically 50 foundation factors to this point in February.

“Now bond markets are waking as much as the chance the Fed hikes charges increased and holds them there for longer,” says BlackRock.

With latest knowledge exhibiting financial exercise is holding up nicely — see the strong labor market –and core inflation is proving stickier than anticipated, BlackRock doesn’t suppose inflation is on monitor again to the Fed’s 2% goal with no recession.

“Which means strong exercise knowledge ought to be seen by its implications for inflation. In different phrases: Excellent news on development now implies that

extra coverage tightening and weaker development later is required to chill inflation. That’s dangerous information for danger belongings, in our view,” says BlackRock.

As a result of the asset supervisor reckons this isn’t a typical financial cycle, it thinks “a brand new funding playbook is required.”

It suggests going obese short-duration Treasuries, which provide 3 times greater than the 1.5% they had been offering only a yr in the past. “We additionally like their capability to protect capital at increased yields on this extra risky macro and market regime.”

Supply: BlackRock

Publicity to funding grade credit score ought to be diminished as a result of the latest danger asset rally has precipitated credit score spreads to tighten an excessive amount of, suggesting buyers are too sanguine.

In equities, BlackRock favors rising markets

EEM

over developed: “We favor EM as their dangers are higher priced: EM central banks are close to the height of their price hikes, the U.S. greenback is broadly weaker in latest months and China’s restart is enjoying out.”

“That’s in distinction to main economies which have but to really feel the complete impression of central financial institution price hikes – and but nonetheless have a too-rosy earnings outlook, in our view. Plus, the chance is rising that DM central banks press forward with extra price hikes.”

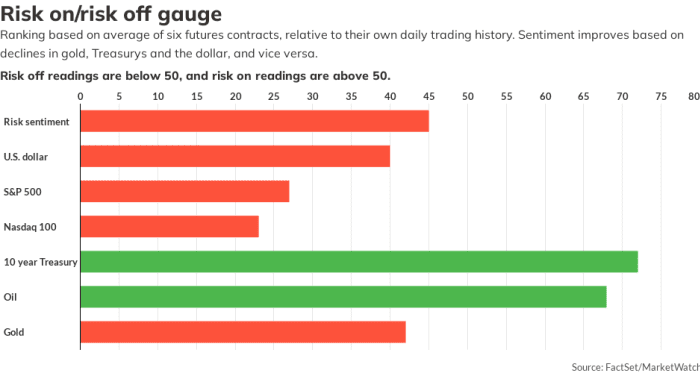

Markets

Inventory-index futures point out a tender opening, with the S&P 500 contract

ES00

off 0.4% and the Nasdaq 100

NQ00

easing 0.8%. The U.S. 10-year Treasury yield

BX:TMUBMUSD10Y

is up 2.3 foundation factors to three.905%, near a 3 month excessive. The greenback index

DXY

is including 0.1% to 104.67.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Each day.

The excitement

On the primary anniversary of Russia’s invasion of Ukraine the Chinese language authorities known as for a ceasefire and proposed a peace plan. Beijing this week refused to again a UN vote condemning Moscow’s invasion. China’s chief Xi Jinping has not known as Ukraine’s president Volodymyr Zelenskyy since Russia’s invasion however has spoken with Vladimir Putin on a number of events.

There’s numerous financial knowledge and Fedspeak for merchants to contemplate on Friday. Arguably of most significance is the non-public consumption expenditure value index for January, due at 8:30 a.m. The PCE index is a popular inflation gauge of the Federal Reserve.

Shopper spending and private revenue knowledge for January may even be printed at 8:30 a.m. adopted at 10 a.m. by January new residence gross sales and the ultimate studying on client sentiment for February.

Fed Governor Phillip Jefferson is because of communicate at 10:15 a.m., the identical time as Cleveland Fed President Loretta Mester. At 11:30 a.m. St. Louis Fed President James Bullard will make some remarks, adopted at 1:30 p.m. by Boston Fed President Susan Collins and Fed Governor Christopher Waller.

Two badly crushed down former inventory darlings are having a greater time in premarket buying and selling. Shares in Past Meat

BYND,

which had been nicely above $200 in 2019, are leaping 14% to flirt with $20 after delivering higher than anticipated outcomes.

In the meantime, Block

SQ

is up greater than 7% to close $80 after the cost know-how group’s earnings had been nicely acquired. Block’s inventory was above $275 in August 2021.

Adobe shares

ADBE

are off 3% following a report the DOJ was trying to block the corporate’s $20 billion buy of Figma .

Better of the net

Eight methods the Russia-Ukraine conflict modified the world.

Timing the market is a loser’s recreation.

We should maintain preventing Russia with banks in addition to tanks, says Browder.

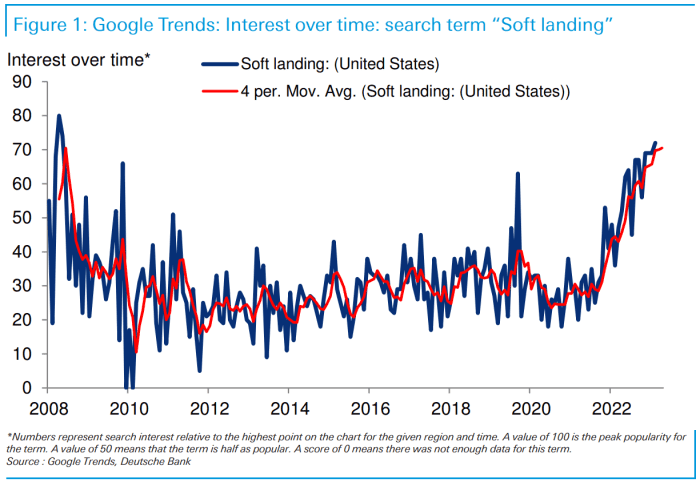

The chart

As alluded to above, one of many causes that shares had a great begin to the yr was that buyers started to suppose the U.S. economic system may escape the Fed’s tightening cycle with a “tender touchdown.” Because the chart beneath from Deutsche Financial institution reveals, U.S.-based searches on Google for the phrase reached a 15-year excessive this month. And everyone knows what tends to open when an concept in markets turns into overly standard.

Supply: Deutsche Financial institution

Prime tickers

Right here had been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Japanese.

| Ticker | Safety identify |

| TSLA | Tesla |

| AMC | AMC Leisure |

| BBBY | Mattress Bathtub & Past |

| NVDA | Nvidia |

| GME | GameStop |

| LUNR | Intuitive Machines |

| NIO | NIO |

| AAPL | Apple |

| APE | AMC Leisure most popular |

| MULN | Mullen Automotive |

Random reads

California man claims successful $2.04 billion Powerball ticket was stolen from him.

80-year janitor can now re-retire after college students increase $200,000.

Ryan Reynolds to take the sector for Wrexham FC.

Must Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.

Hearken to the Finest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton