The debt-ceiling deal could spark a brand new fear: Who will purchase the deluge of Treasury payments?

Now that the U.S. debt-ceiling combat lastly is resolved, the Treasury is predicted to unleash a flood of invoice issuance to assist refill its coffers run low by the protracted standoff in Washington, D.C., over the federal government’s borrowing restrict.

The query is, who will purchase them and at what worth?

Treasury payments are debt issued by the U.S. authorities that mature in 4 to 52 weeks. New invoice issuance might attain about $1.4 trillion by way of the tip of 2023, with roughly $1 trillion flooding the market earlier than the tip of August, in line with an estimate from BofA World strategists.

They count on the deluge by way of August to be about 5 instances the availability of a median three-month stretch in years earlier than the pandemic.

“The excellent news is that we now have a excessive diploma of confidence round who’s going to purchase it,” stated Mark Cabana, charges strategist at BofA World, in a telephone interview with MarketWatch. “The unhealthy information is that it’s not going to be at present ranges. Issues need to cheapen.”

Cabana sees a key purchaser of invoice provide unleashed by a debt-ceiling deal in money-market funds, which have climbed to almost $5.4 trillion in property managed for the reason that regional banking disaster erupted in March (see chart).

So individuals who yanked billions of {dollars} in deposits from banks after the collapse of Silicon Valley Financial institution in March and parked them in money-market funds might find yourself taking part in an encore efficiency on this 12 months’s debt-ceiling drama.

Cash-market funds swell since March, topping $5 trillion in property

BofA World

Associated: Cash-market funds swell to file $5.4 trillion as savers pull cash from financial institution deposits

$2 trillion at Fed repo facility

Cash-market funds have been the principle purpose why at the very least $2 trillion persistently sits in a single day on the Federal Reserve’s reverse repo facility. This system was final providing a roughly 5% price, a degree Cabana stated new Treasury payments would possibly must exceed by about 10-20 foundation factors.

“It’s an unintended consequence of a debt-ceiling deal getting completed,” stated George Catrambone, head of mounted revenue Americas at DWS Group, about market expectations for heavy short-term Treasury invoice issuance, however he additionally expects money-market funds, international patrons and different establishments auctions to proceed as patrons available in the market.

“There’s all the time patrons. It’s a query of worth.”

President Joe Biden on Friday hailed passage of a bipartisan deal to lift the U.S. debt restrict and keep away from a authorities default, addressing the nation from the Oval Workplace.

See: ‘We averted an financial disaster’: Biden hails debt-ceiling deal in Oval Workplace deal with

Biden spoke a day after the Senate, in a late-night session, handed the invoice to elevate the $31.4 trillion debt ceiling and impose some spending limits. The Home of Representatives cleared the measure on Wednesday evening. Biden stated he would signal the invoice on Saturday.

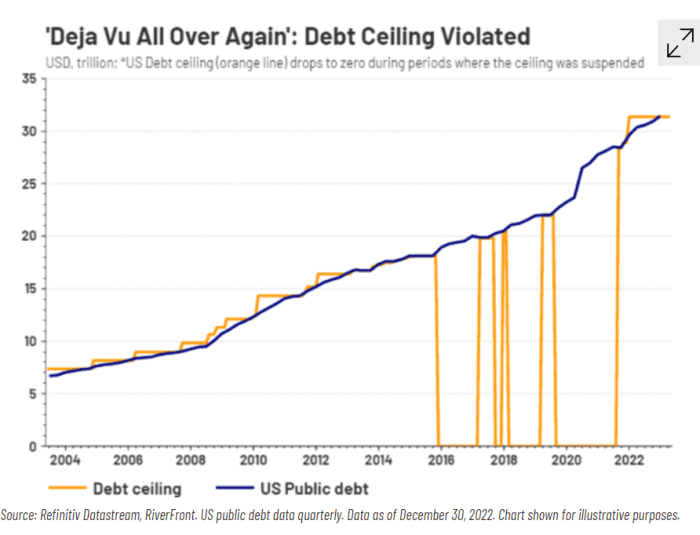

Congress has struck offers every time U.S. public debt has exceeded its debt ceiling previously, together with by suspending it eight instances since 2016 (see chart).

Prior to now when the U.S. debt-limit has been violated, Congress prolonged or suspended it

Refinitive, RiverFront

That doesn’t imply monetary markets have been sitting by idly. The 1-month Treasury yield

TMUBMUSD01M,

and the 3-month yield

TMUBMUSD03M,

each rose previously two weeks as did payments maturing across the “X-date,” or default date on June 5.

Learn: Debt-ceiling angst sends Treasury invoice yields towards 6%

“These are clearly fairly heady yields,” Catrambone stated. “Nevertheless it additionally exemplifies the market having to cost in potential market disruptions within the month of June,” despite the fact that his workforce, like many in monetary markets, count on that finally “cooler heads will prevail” in Washington because the debt-ceiling standoff heads all the way down to the wire.

Shares climbed sharply Friday, as buyers cheered the Senate passing the debt-ceiling invoice Thursday evening whereas weighing the U.S. authorities’s newest month-to-month employment report.

How the cash ran out

The Treasury in January hit its borrowing restrict and started working below “extraordinary measures” to keep away from a default.

Money balances on the Treasury Division have since dwindled to lower than $100 billion, in line with economists at Jefferies.

“Mainly, we’re simply draining our money account to fund operations whereas we wait to determine the debt ceiling,” Lindsay Rosner, senior portfolio supervisor at PGIM Fastened Revenue stated final week.

However now that the battle over the debt restrict has led to a decision, she expects longer-dated Treasury yields to extend, as haven shopping for on fears of doubtless a full U.S. authorities default and a credit standing downgrade may have been taken off the desk.

“The Armageddon, no matter small likelihood individuals have been pricing in of disaster, take away that,” she stated. “And which means the worst financial final result has been eliminated.”

That’s additionally a purpose why Rosner has been avoiding ultrashort Treasurys within the eye of the debt-ceiling combat in favor of two, 3 or 4-year bonds providing a few of the highest yields in years.

“We’re being afforded good yield, good unfold, a few years out the curve,” she stated. “Play that recreation.”