It’s official: Due to the debt-ceiling settlement, debtors and the student-loan system now have three months to arrange for the tip of the greater than three-year freeze on student-loan funds, curiosity and collections.

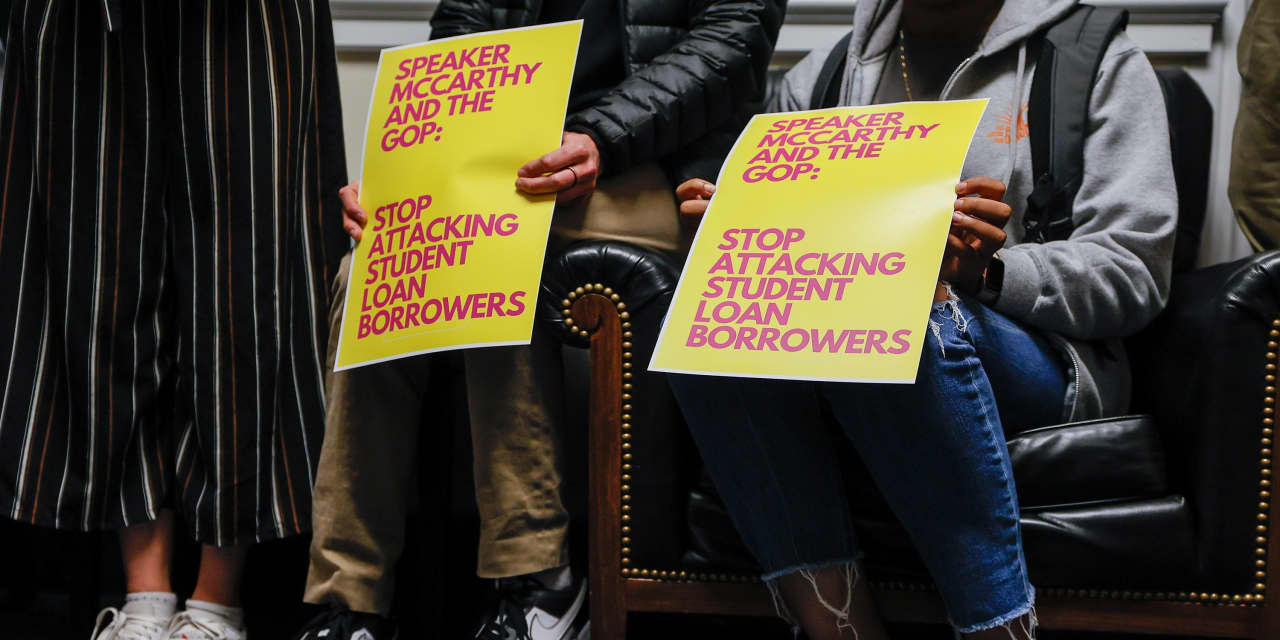

Scholar-loan borrower advocates and even the official accountable for restarting funds have warned ending the pause can be difficult for debtors. Now, some advocates are involved that the debt-ceiling deal has locked officers into resuming funds even when debtors and the student-loan system aren’t prepared and with out the debt-relief the Biden administration has mentioned is critical to make sure a easy transition to reimbursement.

“It’s actually disappointing to have such a inflexible, rigid reimbursement restart date,” mentioned Persis Yu, managing counsel and deputy govt director of the Scholar Borrower Safety Middle, an advocacy group. That inflexibility “goes to be actually damaging for debtors and ties the administration’s fingers.”

How are you getting ready for pupil mortgage funds to renew? We need to know: Electronic mail jberman@marketwatch.com.

Beneath the deal reached by President Joe Biden and Home Speaker Kevin McCarthy to lift the debt restrict, the student-loan fee pause would finish sixty days after June 30, 2023. The invoice, which is headed to Biden for his signature, after the Senate handed it Thursday, would additionally prohibit the Secretary of Training from extending the fee pause with out an act of Congress.

In a way, the debt-limit invoice codifies what the Biden administration has mentioned is its plan for resuming funds for months and staves off extra drastic cuts to student-loan aid which were a part of the debt-limit debate. But it surely additionally provides officers little room to alter their plans if the Supreme Court docket knocks down the Biden administration’s proposal to cancel as much as $20,000 in pupil debt for a large swath of debtors — one thing they’ve argued is vital to restarting student-loan funds with out widespread delinquency and default.

Since November the Biden administration has mentioned student-loan funds will resume 60 days after June 30 on the newest they usually’ve been dealing with strain, together with from Republican members of Congress and litigation to stay to that deadline. The language within the bipartisan debt-limit settlement doesn’t go so far as Republicans’ debt-limit proposal to curtail student-debt aid. That invoice, which the Home handed in April, eliminates the Biden administration pupil debt forgiveness plan.

Each throughout oral arguments on the Supreme Court docket and in public feedback, Biden administration officers have warned that restarting funds with out the debt aid would push many debtors into delinquency and default on their pupil loans. Within the weeks and months main as much as when funds have been scheduled to renew the final eight instances, advocates have mentioned that each debtors and the system weren’t prepared for funds to show again on. For years, they’ve urged the Biden administration to not begin sending student-loan payments with out some form of mass cancellation that would assist cushion the blow to each debtors’ wallets and the system extra broadly.

Customer support hours reduce

Within the months since President Biden mentioned funds would resume by the tip of the summer time, situations have modified that may seemingly make the return to reimbursement much more difficult, Yu mentioned. The Division of Training is paying student-loan servicers much less cash per account and servicers have reduce name heart hours — providing none on weekends. The Division has mentioned the cuts are a results of lawmakers’ determination to not totally fund the Workplace of Federal Scholar Help, which oversees the coed mortgage system.

“We now know that servicers are in a a lot worse place than they have been,” when the date to restart funds was initially introduced, Yu mentioned. The debt-limit invoice “locks” the Biden administration “into restarting a damaged pupil mortgage system, and actually ties their fingers and places pupil mortgage debtors on the mercy of the Supreme Court docket.”

Richard Cordray, the chief working officer of Federal Scholar Help, instructed lawmakers final week that his workplace is “working intently” with mortgage servicers and different stakeholders to “execute a complete plan based on clear communication, high-quality customer support, and focused assist for these having bother making their funds.”

“We all know the transition again into reimbursement is not going to be straightforward for debtors, and we’re dedicated to giving them the knowledge and sources they should succeed when funds resume,” he mentioned in his written testimony.

The Division hasn’t introduced the small print of the way it will do this, however some reporting signifies it may, for instance, supply debtors a comparatively lengthy grace interval in the event that they miss funds after the freeze ends.

Scott Buchanan, the chief director of the Scholar Mortgage Servicing Alliance, a commerce group, mentioned servicers are hoping to get the go-ahead from the Division of Training to speak with debtors in regards to the begin to reimbursement as quickly because the debt ceiling invoice turns into regulation (if it certainly passes).

“We’ve all the time been involved about compressed timelines of a few months,” he mentioned. “That’s actually not adequate time to arrange debtors for this variation.”

Betsy Mayotte, the president and founding father of the Institute for Scholar Mortgage Advisors, mentioned it doesn’t matter what steps the Division takes to ease the transition and regardless of how a lot time officers needed to put together for funds to show again on, ending the freeze was going to be a frightening process. Certainly, when student-loan funds resumed after previous, extra restricted pauses, defaults and delinquencies spiked.

“Regardless of how a lot prepwork we do, the system wasn’t constructed — and you may’t put together — for 30 million or what number of million it’s debtors to all restart reimbursement on the similar time,” she mentioned. “That is going to be a tidal wave.”

Some advocates have pushed for the Division of Training to make main adjustments to the student-loan system earlier than resuming funds so it may higher stand up to the tip of the freeze. The Biden administration has introduced a number of initiatives aimed toward remodeling the expertise of repaying pupil debt, however many elements of the system are unchanged from earlier than the pandemic, when greater than 1 million debtors defaulted on their pupil loans every year.

For instance, debtors who’ve the appropriate to have their debt discharged underneath the regulation, might wind up making funds on loans that needs to be cleared from the books when funds resume, Yu mentioned. As well as, the Biden administration’s proposal to make pupil mortgage funds extra inexpensive seemingly received’t be prepared by the tip of the summer time. And the Division of Training hasn’t carried out a measure handed by Congress that might make it simpler for debtors to stay on an inexpensive reimbursement plan and never face a shock massive fee attributable to paperwork mishaps.

For his or her half, debtors ought to begin getting ready now for funds to renew, as they will count on protracted name wait instances and an extended than typical turnaround for paperwork because the deadline for pupil mortgage payments will get nearer, Mayotte mentioned. Under are some steps to take.

Tips on how to put together for funds to renew:

Discover your pupil loans: Scholar-loan servicers are debtors’ first level of contact when making funds or altering their fee plan. However after three years with out funds — or in the event that they’re making funds for the primary time — debtors might not know who their servicer is, notably as a result of debtors’ loans might have been transferred after some massive servicers left the student-loan program. To seek out out who’s dealing with their loans debtors ought to head to studentaid.gov, Mayotte says.

“In the course of the pause we additionally had a whole lot of servicer adjustments and people proceed as we communicate,” she mentioned.

Work out your month-to-month fee: Debtors can use free calculators on the Division of Training’s web site or on the web site of Mayotte’s group to determine how a lot their month-to-month pupil mortgage invoice can be underneath totally different reimbursement plans. Beneath the usual plan, which debtors are enrolled into by default after they depart faculty, debtors can pay their loans off in 10 years by means of mortgage-style funds.

If that doesn’t appear inexpensive, debtors ought to take steps, together with getting in contact with their servicer, to enroll in an income-driven plan. Beneath these reimbursement schemes, debtors repay their debt as a share of their earnings.

“Making use of for a decrease fee possibility now’s going to keep away from the avalanche for requests for these decrease fee choices and it received’t begin their funds any sooner,” Mayotte mentioned.

The Biden administration has proposed sweeping adjustments to income-driven reimbursement, which may make it extra inexpensive and fewer onerous for a lot of debtors. Their model of the plan seemingly received’t be accessible by the tip of the summer time when funds are set to renew. However debtors who enroll in a special plan can all the time swap, when the brand new plan turns into official, Mayotte mentioned. As well as, the Division of Training has mentioned that debtors who join one of many plans already accessible, known as REPAYE, will mechanically be enrolled within the new plan when it’s carried out.

Enroll in auto debit: In remarks to lawmakers final week, Cordray suggested debtors who know they will make their funds to enroll in auto debit. The federal authorities provides 1 / 4 of a share level low cost for auto debit and by setting it up debtors might be certain they received’t miss their funds.

Get the ball rolling to make the most of different adjustments to the coed mortgage system: Debtors utilizing income-driven reimbursement plans can have their remaining steadiness canceled after as much as 25 years of funds, however many debtors spent years in reimbursement choices that didn’t rely in direction of that forgiveness as a result of servicers steered them in that route, in line with the Division. Beneath an initiative the Biden administration introduced final yr, debtors can have time spent in forbearance rely in direction of that aid, bringing them nearer to forgiveness.

However some debtors should take motion with a view to entry this profit. Debtors with Federal Household Training Loans must consolidate their loans into Direct federal pupil loans by the tip of the yr if they need their account to be adjusted. Mayotte says debtors who must ought to take steps to consolidate “sooner moderately than later.”

“Conserving in thoughts the avalanche that we’re anticipating to hit the servicing facet of issues,” she added.

There’s a gaggle of debtors who’re an exception to this recommendation, she famous. Debtors who’ve a commercially-held FFEL mortgage — or a mortgage that’s held by a personal lender, however backed by the federal authorities — ought to wait till the Supreme Court docket points its determination on debt aid, Mayotte mentioned. That’s as a result of as soon as these debtors consolidate they seemingly can be barred from receiving mass debt forgiveness.

As well as, debtors who’re in default on their loans ought to begin taking steps to profit from a Biden administration initiative aimed toward serving to this group. For a yr following the pause these debtors can be present on their loans underneath a program known as Contemporary Begin.

However with a view to keep present on their loans as soon as that yr is up, they should take motion. Mayotte says debtors in default ought to discover out who owns their loans (extra data on how to try this right here). Then they need to name that group and say they need to make the most of Contemporary Begin, she mentioned. As soon as their mortgage is transferred to a mortgage servicer they need to get in contact with that group to enroll in an inexpensive reimbursement plan, she mentioned.

Be careful for scams: “As we’re getting all the way down to the wire particularly with all these distinctive and momentary applications on the market that is simply fodder for the scammers,” Mayotte mentioned. Any entity that’s asking for cash to enroll in a authorities reimbursement or forgiveness program is a rip-off, she mentioned. Scholar mortgage servicers are paid by the federal government to handle these applications for free of charge to debtors.

Debtors “ought to by no means should pay for pupil mortgage recommendation,” Mayotte mentioned.