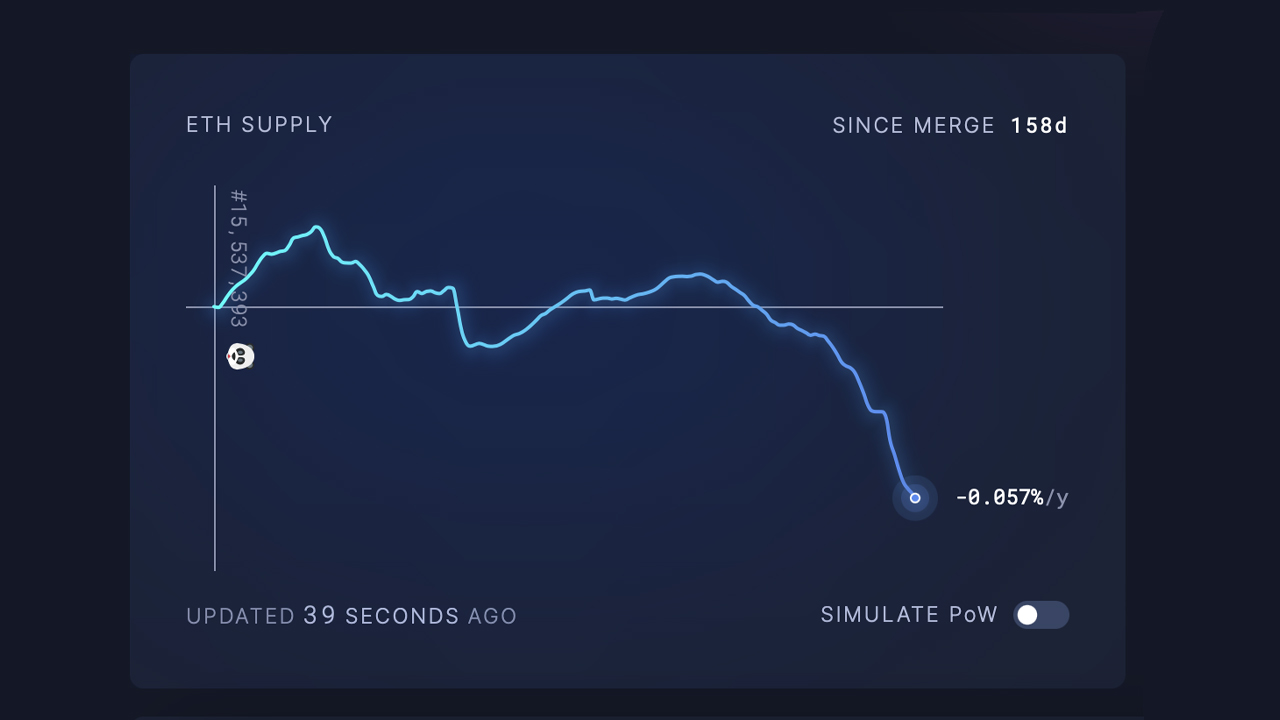

After the transition from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum’s annual issuance charge has been decreased to unfavourable 0.057%, in response to statistics 158 days after The Merge. The metrics point out that extra ethereum tokens have been eliminated than issued, and if the chain have been nonetheless beneath PoW consensus, 1,823,678 ether would have been minted so far.

Ethereum’s Unfavourable Annual Issuance and Unlocked Ether in March May Shift Equilibrium

Statistics from the analytics web site ultrasound.cash present that the Ethereum community is deflationary nowadays. Greater than 1.023 million ether is faraway from circulation yearly, in response to metrics following the London arduous fork’s implementation of EIP-1559. Because the transition from proof-of-work (PoW) to proof-of-stake (PoS) often called The Merge, the present annual issuance charge is unfavourable 0.057% or -29,797 ether.

The info exhibits that extra ethereum (ETH) is at the moment being faraway from circulation than is being issued. If Ethereum have been nonetheless utilizing PoW, the issuance charge would enhance by about 3.49% yearly. As of 10:30 a.m. (ET) on Feb. 20, 2023, knowledge signifies that 1,823,678 ethereum tokens would have been added to the variety of cash in circulation beneath PoW consensus. As of 10:55 a.m. (ET) on the identical day, roughly 120,491,331 ethereum (ETH) tokens are in circulation.

At that very same time, 16,763,815 ether is locked into the Beacon chain contract, and when the Shanghai replace happens in March, lots of these cash may very well be launched from their locked state. The locked ether represents $28.61 billion of the second-largest cryptocurrency’s $205.77 billion market valuation, or 13.91% of the circulating provide and market worth. Based on statistics from ultrasound.cash, Ethereum’s present annual issuance rewards are 4.1%, and the burn charge for non-stakers is 1.8% per 12 months.

What do you assume the longer term holds for Ethereum’s issuance charge and circulating provide because the community continues to transition to proof-of-stake and implement updates just like the upcoming Shanghai replace? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: ultrasound.cash

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.