A big shift has occurred within the US spot Bitcoin exchange-traded funds (ETFs) sector. The most recent knowledge from K33 Analysis has revealed an accumulation of Bitcoin property by the newly launched spot Bitcoin ETFs, excluding Grayscale’s Bitcoin Belief (GBTC).

Inside 13 days of buying and selling, these new spot ETFs have collectively racked up over 150,000 BTC in property, showcasing their speedy development and growing market affect.

The web inflows for these new spot ETFs have been fairly substantial, exceeding $1 billion yesterday alone, in keeping with BitMEX Analysis.

This surge in inflows marks a notable shift out there dynamics, as GBTC, as soon as a dominant participant, sees its market share in buying and selling quantity shrink to 36%, in keeping with knowledge from IntoTheBlock. This decline starkly contrasts its earlier peak of 63.9% on January 17.

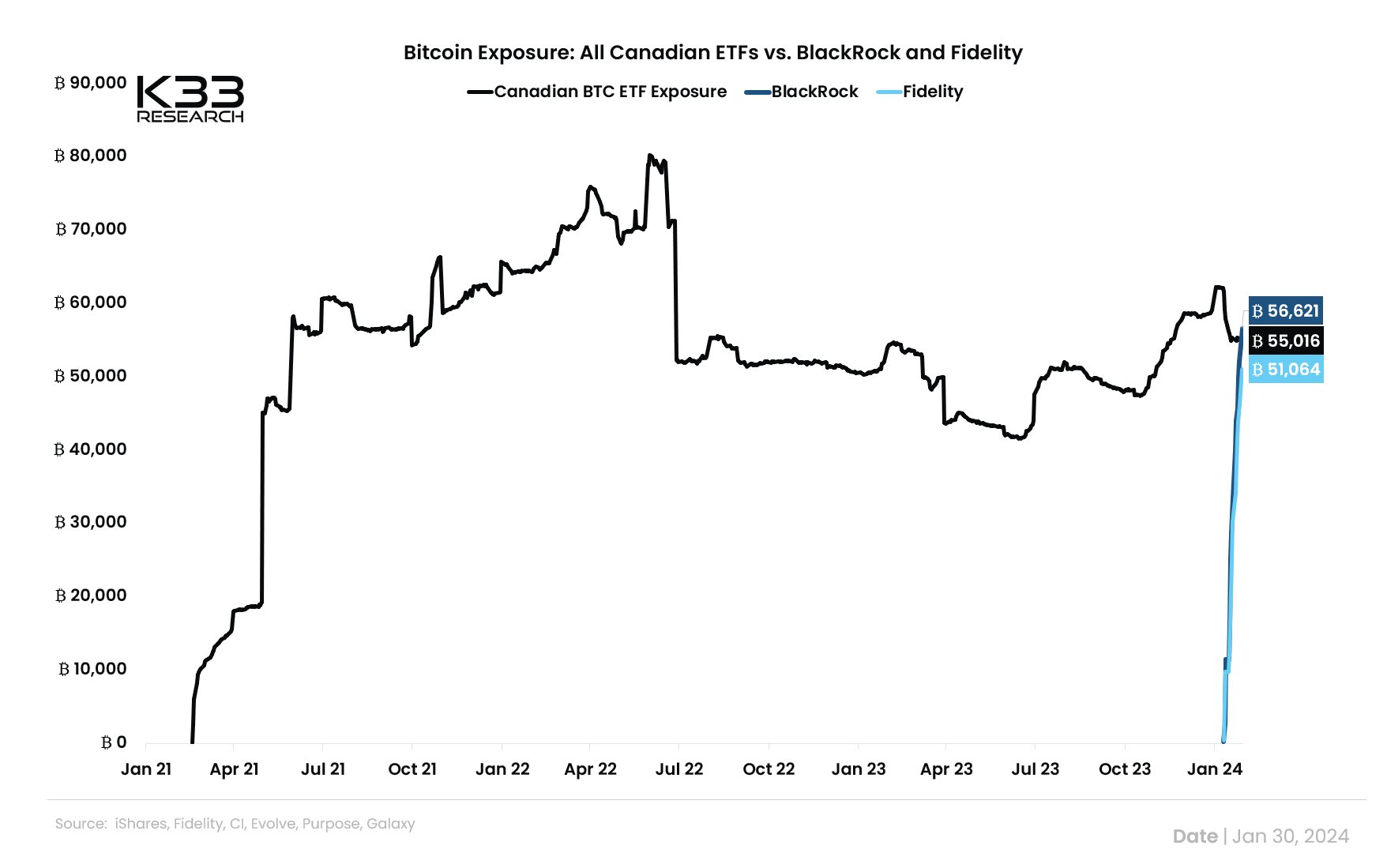

BlackRock’s IBIT Outshines Canadian Bitcoin ETFs

Among the many new entrants which embrace BlackRock (IBIT), Constancy (FBTC), Ark 21Shares (ARKB), Invesco (BTCO), Bitwise (BITB), Valkyrie (BRRR), Franklin Templeton (EZBC), WisdomTree (BTCW), and VanEck (HODL), BlackRock’s IBIT spot Bitcoin ETF has emerged as a formidable participant, surpassing the mixed property below administration (AUM) of all Canadian Bitcoin ETFs.

As of the newest knowledge from K33 Analysis, IBIT holds 56,621 BTC, valued at roughly $2.5 billion, overtaking the AUM of outstanding Canadian ETFs like CI Galaxy Bitcoin ETF and Function Bitcoin ETF, which sit at 55,016 BTC or $2.4 billion.

Constancy’s US spot BTC ETF, FBTC, additionally follows carefully, holding roughly 51,064 BTC as of the newest replace.

The substantial inflows into these spot ETFs, particularly BlackRock’s IBIT and Constancy’s FBTC, which have recorded inflows of $208.2 million and $198.4 million, respectively, underscore the rising investor curiosity and confidence in these monetary merchandise.

January 30

150,000 BTC is held by the brand new ETFs – in lower than three weeks!

Important slowdown of GBTC outflows led yesterday to see the strongest every day U.S. spot flows since January 17.

BlackRock wanted 13 buying and selling days for its AUM to surpass all Canadian BTC ETFs mixed. pic.twitter.com/C7Tb9fNsd5

— Vetle Lunde (@VetleLunde) January 30, 2024

Grayscale’s Place In The Market

Grayscale, a monetary behemoth within the BTC house, regardless of its market share plunge within the spot ETF house, continues to maintain a big quantity of BTC, with its holdings amounting to 496,573 BTC as of January 29.

As of January 29, 2024, the variety of Bitcoins held by Grayscale was 496,573.8166. Moreover, GBTC’s AUM is roughly $21.431 billion. After the spot ETF handed, Grayscale customers offered a complete of 120,500 BTC, which is equal to roughly $5.508 billion.…

— Wu Blockchain (@WuBlockchain) January 30, 2024

Nonetheless, the corporate’s latest actions point out a slowdown in its sell-offs, following a substantial whole deposit of $4.91 billion BTC to Coinbase.

In line with BitMEX analysis in an X put up, GBTC had seen an outflow of $192 million on January 29, considerably decrease than its regular outflow prior to now week which ranged above $300 million.

Featured picture from Unsplash, Chart from TradingView