Tuesday’s CPI information seems to have overshot some expectations on Wall Avenue and inventory futures are promoting off. The upshot: an overshoot may sprint hopes of a Could charge lower and curtail the S&P 500’s

waltz with 5,000. The day is younger.

But with Nvidia

NVDA

up one other 47% to this point this yr, and AI driving a frenzy for corporations corresponding to ARM

ARM,

and any others that get close to it, not standing in entrance of the ChatGPT prepare appears sensible for now. Certainly, Financial institution of America’s newest fund supervisor survey reveals no letup within the tech-stock shopping for.

Learn: Arm’s frenzied inventory rally continues as AI chase trumps valuation.

What would possibly take this market down finally? Our name of the day from former hedge-fund supervisor Russell Clark factors to Japan, an island nation whose central financial institution is among the final holdouts of unfastened financial coverage.

Notice, Clark bailed on his perma bear RC World Fund again in 2021 after wrongly betting in opposition to shares for a lot of a decade. However he’s bought a complete concept on why Japan issues a lot.

In his substack put up, Clark argues that the true bear-market set off will come when the Financial institution of Japan ends quantitative easing. For starters, he argues we’re in a “pro-labor world” the place a couple of issues must be enjoying out: increased wages and decrease jobless ranges and rates of interest increased than anticipated. Lining up along with his expectations, actual belongings began to surge in late 2023 when the Fed began to go dovish, and the yield curve started to steepen.

From that time, not every part has been matching up so simply. He thought increased short-term charges would siphon off cash from speculative belongings, however then cash flowed into cryptos like Tether and the Nasdaq recovered fully from a 2022 rout.

“I’ve been toying with the concept that semiconductors are a the brand new oil – and therefore have develop into a strategic asset. This explains the surge within the Nasdaq and the Nikkei to a level, however does probably not clarify tether or bitcoin very properly,” he stated.

So again to Japan and his not so standard clarification for why monetary/speculative belongings proceed to commerce so properly.

“The Fed had excessive rates of interest all by means of the Nineties, and dot-com bubble developed anyway. However throughout that point, the Financial institution of Japan solely lastly raised rates of interest in 1999 after which the bubble burst,” he stated.

He notes that when Japan started to tighten charges in late 2006, “every part began to unwind,” including that the BOJ’s transient makes an attempt [to] increase charges in 1996 could possibly be blamed for the Asian Monetary Disaster.

In Clark’s view, markets appear to have moved extra with the Japan’s financial institution steadiness sheet than the Fed’s. The BOJ “invented” quantitative easing within the early 2000s, and the subprime disaster began not lengthy after it eliminated that liquidity from the market in 2006, he notes.

“For actually outdated traders, unfastened Japanese financial coverage additionally defined the bubble economic system of the Eighties. BOJ Steadiness Sheet and S&P 500 have first rate correlation in my e-book,” he stated, providing the beneath chart:

Capital Flows and Asset Markets, Russell Clark.

Clark says that additionally helps explains why increased bond yields haven’t actually damage belongings. “As JGB 10 yields have risen, the BOJ has dedicated to limitless purchases to maintain it beneath 1%,” he notes.

The 2 massive takeaways right here? “BOJ is the one central financial institution that issues…and that we have to get bearish the U.S. when the BOJ raises rates of interest. Given the strikes in bond markets and meals inflation, this can be a matter of time,” stated Clark who says in mild of his plans for a brand new fund, “a bear market can be extraordinarily helpful for me.” He’s watching the BOJ intently.

The markets

U.S. inventory futures

ES00

NQ00

prolonged declines as client costs rose by 0.3% in January and core costs rose by 0.4%. The yield on the 2-year

shot up 14 foundation factors.

| Key asset efficiency | Final | 5d | 1m | YTD | 1y |

| S&P 500 | 5,021.84 | 1.60% | 4.98% | 5.28% | 21.38% |

| Nasdaq Composite | 15,942.55 | 2.21% | 6.48% | 6.20% | 34.06% |

| 10 yr Treasury | 4.181 | 7.83 | 11.45 | 30.03 | 42.81 |

| Gold | 2,038.10 | -0.17% | -0.75% | -1.63% | 9.33% |

| Oil | 77.14 | 5.96% | 6.02% | 8.15% | -2.55% |

| Information: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The excitement

Biogen

BIIB

inventory is down on disappointing outcomes and a gradual launch for its Alzheimer’s remedy. A miss can be hitting Krispy Kreme

DNUT,

Coca-Cola

KO

is up on a income rise. Hasbro inventory

HAS

is plunging on an earnings miss, whereas Shopify

SHOP

can be down after outcomes.

JetBlue

JBLU

is surging after billionaire activist investor Carl Icahn disclosed a close to 10% stake and stated his agency is discussing potential board illustration.

Tripadvisor inventory

TRIP

is up 10% after the travel-services platform stated it was contemplating a potential sale.

In a primary, Russia put Estonia’s prime minister on a “needed” listing. In the meantime, the U.S. Senate authorised support for Ukraine, Israel and Taiwan.

Better of the net

Why chocolate lovers can pay extra this Valentine’s Day than they’ve in years

A startup needs to reap lithium from America’s largest saltwater lake.

On-line playing transactions hit almost 15,000 per second in the course of the Tremendous Bowl.

The chart

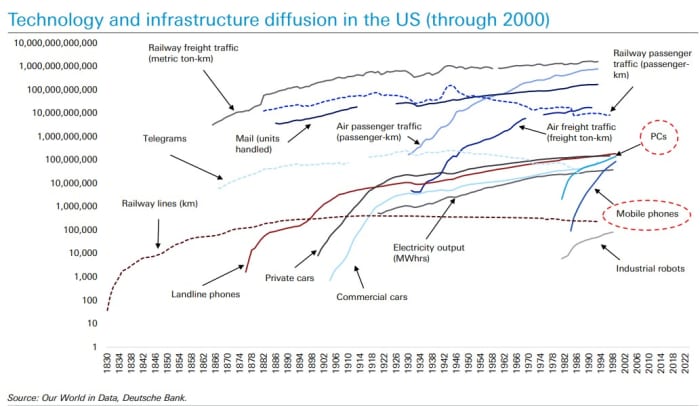

Deutsche Financial institution has taken a deep dive into the would possibly of the Magnificent Seven, and why they’ll proceed to matter for traders. One purpose? Almost 40% of the world nonetheless doesn’t have web entry because the financial institution’s chart reveals:

Prime tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.

Random reads

Everybody needs this freak “It bag.”

Dumped over a textual content? Get your free dumplings.

Messi the canine steals Oscars’ limelight.

Love and thousands and thousands of flowers cease in Miami.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.

Take a look at On Watch by MarketWatch, a weekly podcast concerning the monetary information we’re all watching – and the way that’s affecting the economic system and your pockets.