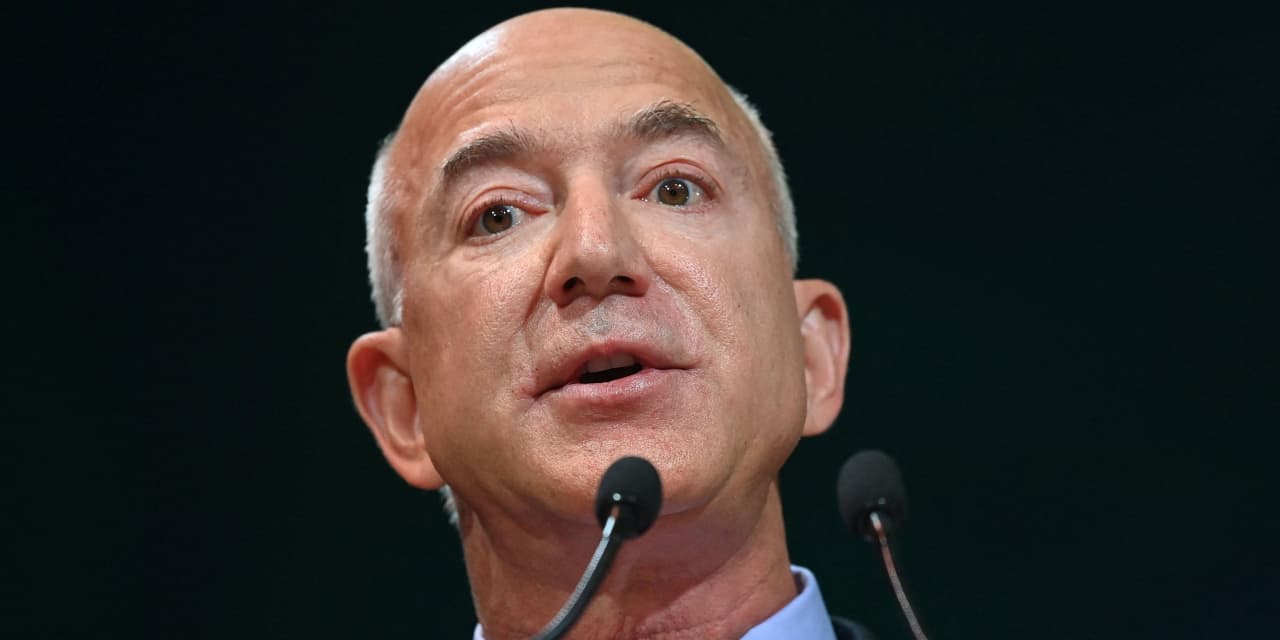

Amazon.com Inc. founder and government chair Jeff Bezos continues to promote inventory, dumping one other $2 billion as a part of a buying and selling plan.

A brand new submitting with the Securities and Change Fee on Tuesday reveals that Bezos unloaded 12 million extra Amazon shares

AMZN,

throughout a collection of transactions Friday and Monday. He dumped roughly the identical quantity in a bout of promoting completed final Wednesday and Thursday, a previous SEC submitting indicated.

Probably the most not too long ago disclosed gross sales passed off at costs between $170.61 and $175.34.

See extra: Jeff Bezos simply bought $2 billion in Amazon inventory. That doesn’t imply it is best to promote too.

Bezos’ $4 billion value of transactions got here as a part of a 10b5-1 buying and selling plan, which is about as much as enable firm insiders like board members and executives to promote inventory when predetermined situations are triggered. He adopted his present plan in November 2023, although Amazon disclosed it in its 10-Okay earlier this month.

By way of the present plan, Bezos can promote as much as 50 million shares of Amazon by the top of January 2025. VerityData analysis vp Ben Silverman beforehand famous that Bezos was more likely to focus gross sales over a number of days fairly than spreading them out over weeks or months, primarily based on a assessment of his previous promoting exercise.

Bezos’ February gross sales are his first since November 2021, Silverman famous. He dumped 60 million shares that yr after unloading 80 million in 2020.

See additionally: Nvidia closes with a market cap above Amazon’s for first time since 2002

Insider gross sales, even ones performed via 10b5-1 plans, can generally be telling for traders who’re taking a look at the place executives and board members are keen to promote. However Silverman stated after Bezos’ first $2 billion sale this month that his previous promoting exercise didn’t show to be a very good predictor of how Amazon’s inventory went on to carry out.

An Amazon spokesperson didn’t instantly reply to a MarketWatch request for remark in regards to the newest transactions.