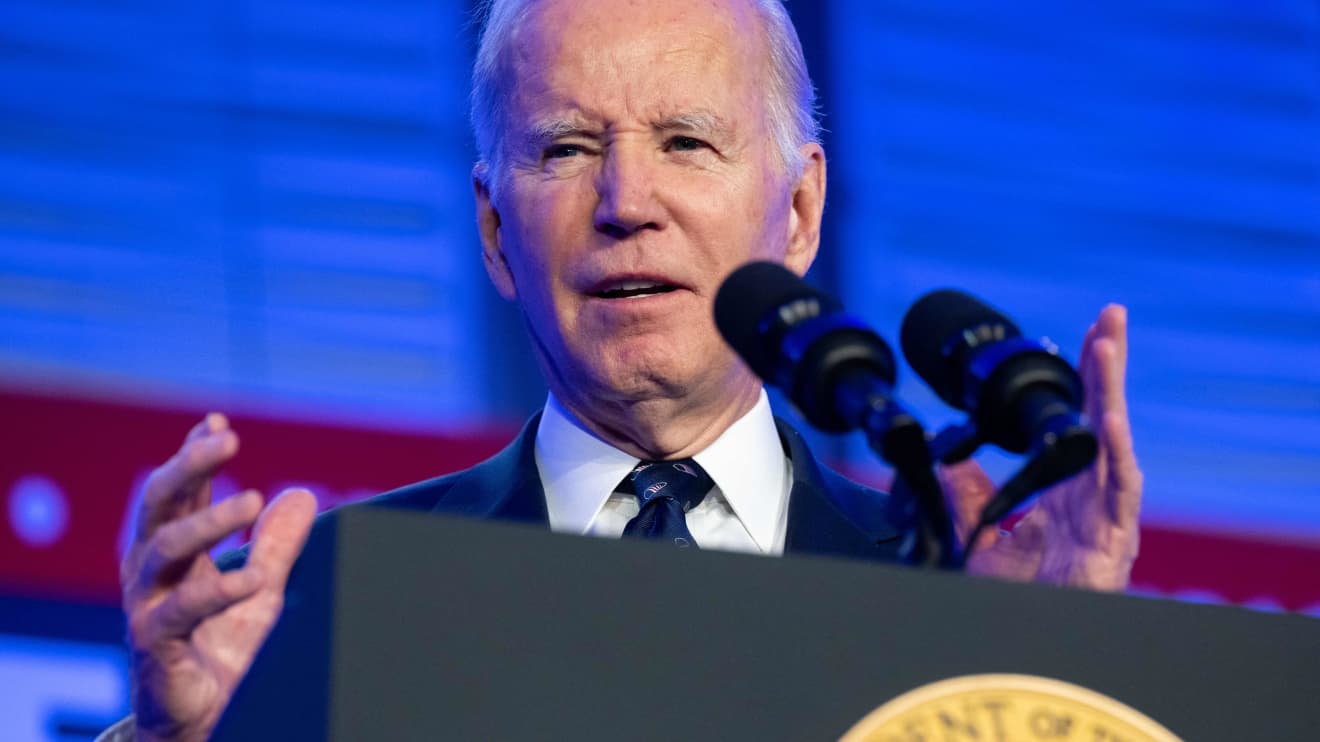

President Joe Biden on Thursday known as for ending tax subsidies for cryptocurrency traders, the true property business and the oil and fuel sector, as he formally rolled out his proposed price range for the 2024 fiscal 12 months.

Biden is aiming for “reducing wasteful spending on Massive Pharma, Massive Oil and different particular pursuits,” stated Shalanda Younger, director of the president’s Workplace of Administration and Finances, throughout a name with reporters.

His proposed price range would ship an estimated $24 billion in financial savings by eliminating a tax subsidy for crypto traders that enables them to promote a cryptocurrency corresponding to bitcoin

BTCUSD,

at a loss and take a tax loss to cut back their tax burden, however then purchase again that very same asset the following day, in keeping with the White Home.

See: Cryptocurrency investor losses are being changed into IRS good points, as there’s no wash sale rule

The price range would supply financial savings of $19 billion by closing a “like-kind change” loophole for actual property

VNQ,

traders, which lets them postpone paying taxes on income from offers indefinitely so long as they preserve investing in actual property.

It might get $31 billion in financial savings by eliminating particular tax remedy for oil and fuel

XOP,

firm investments, in addition to different fossil gas tax preferences, the White Home stated.

Most of the president’s price range proposals aren’t anticipated to search out a lot traction within the Republican-run Home of Representatives, however they might assist present the Democratic incumbent with speaking factors in a 2024 re-election marketing campaign.

As well as, Biden’s proposals — which he’s slated to debate in a speech delivered round 2:30 p.m. Jap Thursday within the swing state of Pennsylvania — are more likely to issue into his discussions with Home Republicans over elevating the debt restrict.

The president would enhance spending on issues just like the Social Safety Administration, which might see an increase of $1.4 billion over the 2023 enacted stage to fund spending on employees and IT or different enhancements. Colleges in low-income communities would get a $2.2 billion enhance, and the Superior Analysis Tasks Company for Well being (ARPA-H) would rating a rise of $1 billion.

The proposed price range has general outlays totaling $6.88 trillion, up from an estimated $6.37 trillion in spending for the present fiscal 12 months.

There could be $5.04 trillion in income, leading to a deficit of $1.85 trillion.

Biden’s price range takes goal on the prescription drugs business

PJP,

partially by aiming to construct on the Inflation Discount Act’s transfer to permit Medicare to barter costs for some medicine. It requires letting this system negotiate costs for extra medicine and bringing medicine into negotiation sooner after they launch.

His price range targets wealthier People’ retirement investments, because it proposes limiting the quantity that these making over $400,000 a 12 months can maintain in tax-favored retirement accounts, in a transfer that will ship estimated financial savings of $23 billion.

It requires ending the carried-interest loophole, which permits managers of private-equity funds to pay decrease tax charges, at the same time as Biden’s push on that concern flopped final 12 months when Democrats had slim majorities in each chambers of Congress.

It options contemporary makes an attempt by Biden to boost taxes on U.S. firms, because it proposes mountaineering the company tax price to twenty-eight% from 21%, lifting the tax price on international earnings to 21% from 10.5%, and quadrupling the levy on inventory buybacks.

Biden and different Democrats have known as for Home Republicans to put out their very own proposed price range, however Home Speaker Kevin McCarthy reportedly has stated it may very well be two months earlier than they’ve one.

McCarthy and his fellow Republicans have been demanding spending cuts in change for lifting the ceiling on federal borrowing, whereas Biden and his fellow Democrats have stated it needs to be raised with out circumstances.

Associated: CBO warns of potential for U.S. default between July and September, as debt-limit standoff persists

One other a part of Biden’s price range is a proposal to bolster Medicare by elevating the Medicare tax price on earned and funding earnings to five% from 3.8% for folks making greater than $400,000 a 12 months.

There are additionally different proposed measures that will elevate taxes on the rich, corresponding to a billionaire minimal tax.

The price range would reduce the deficit by nearly $3 trillion over 10 years, in keeping with the White Home.