Bitcoin and Ethereum have been unable to reverse their downward development and remained underneath strain. Whereas BTC is hovering across the $23,500 degree as traders opted for safer funding choices amidst rising macroeconomic uncertainties.

Nonetheless, the sharp decline in Bitcoin’s worth got here after the discharge of a collection of strong US knowledge that indicated a strengthening US economic system and lowered the necessity for presidency assist within the type of low-interest charges.

This induced considerations amongst traders and merchants about inflation and the potential for rate of interest hikes.

The worldwide cryptocurrency market is at the moment experiencing a downturn, with Bitcoin struggling to surpass the crucial $23,750 resistance degree, which may lead to a drop in value to $22,800. Within the final 24 hours, Ethereum has additionally skilled a 0.99% lower in its worth.

Bearish Crypto Market & Rising Inflation Considerations

This week, the worldwide cryptocurrency market has seen a decline, dropping from $1.11 trillion to $1.07 trillion firstly of Tuesday. Bitcoin (BTC), the oldest and most respected cryptocurrency, has been buying and selling across the $23,000 degree.

Different in style cryptocurrencies, resembling Dogecoin (DOGE), Litecoin (LTC), Ripple (XRP), and Solana (SOL), have additionally skilled minor losses.

This is because of traders being cautious about investing in riskier property, as they’re involved in regards to the mounting macroeconomic points which have been worsened by higher-than-expected inflation charges.

Bulls Take Management as Poor Financial Statistics Weigh Down Markets

Bitcoin’s latest downward development is probably not long-lasting, because the US Commerce Division introduced on February 27 that sturdy items orders had fallen 4.5% in January from the earlier month. This has elevated the strain on the Federal Reserve to finish its rate of interest hike program sooner than anticipated.

On Monday, the US Census Bureau launched knowledge indicating that orders for sturdy items within the US declined by $13 billion or 4.5% to succeed in $272.3 billion in January, which is barely decrease than market expectations of a 4% decline, following a 4% improve in December.

These statistics counsel that the Federal Reserve could finish its rate of interest hike program prior to anticipated.

UK Banking Regulator to Suggest Rules for Issuing Cryptocurrencies

The Monetary Providers and Markets laws is predicted to permit the Financial institution of England’s Prudential Regulation Authority to assist world financial development. Vicky Saporta, the chief director of the Prudential Coverage Directorate on the Financial institution of England (BOE), introduced in a speech on February 27 that the Prudential Regulatory Authority (PRA), which is the banking regulator of the nation, plans to introduce rules for the issuance and possession of digital property.

Though the transfer by the Prudential Regulation Authority to suggest rules for issuing and proudly owning digital property could also be seen as constructive information for the cryptocurrency business, it’s unlikely to have an instantaneous impression on cryptocurrency costs.

Upcoming Financial Occasions

Merchants might be intently monitoring the discharge of China’s February Buying Managers’ Index (PMI) on Wednesday. Regardless of expectations that the information will present a rise in enterprise exercise from the earlier month, the nation’s large manufacturing sector continues to be anticipated to stay near the contraction zone.

This improvement is necessary for the worldwide economic system as China is the world’s second-largest economic system and a big contributor to worldwide commerce.

As well as, market consideration can be on the upcoming US PMI knowledge, in addition to client sentiment and labor market indicators for January and This autumn. Any indications of financial power within the US may give the Fed extra room to proceed elevating rates of interest, which may very well be destructive for cryptocurrencies.

Bitcoin Worth

Right now’s Bitcoin value is $23,435 with a $22.2 billion 24-hour buying and selling quantity. Bitcoin has fallen by 0.30% within the final 24 hours. With a reside market cap of $452 billion, CoinMarketCap at the moment ranks first. It has a most provide of 21,000,000 BTC cash and a circulating provide of 19,303,806 BTC cash.

The BTC/USD pair’s technical outlook stays comparatively unchanged, as BTC stays consolidated under the resistance degree of $23,750 whereas sustaining quick assist at $22,800. If the worth drops under this degree, Bitcoin could encounter assist at $22,150.

Nonetheless, because the BTC/USD pair is within the oversold zone, a rebound may happen, probably breaking by means of the resistance degree of $23,750 and resulting in a value improve of $24,250.

The BTC/USD pair’s quick assist degree is at $22,800, and if it breaks under this degree, it may probably expose the worth of BTC to the following assist space on the $22,150 degree.

Purchase BTC Now

Ethereum Worth

As of now, Ethereum is priced at $1,628 with a 24-hour buying and selling quantity of $6.9 billion. Up to now 24 hours, the worth has decreased by 0.50%. Based on CoinMarketCap, Ethereum holds the second place with a present market cap of $199.2 billion.

From a technical standpoint, the ETH/USD pair is at the moment encountering a near-term impediment on the $1,665 degree, and surpassing this barrier could reveal additional upward motion towards the $1,725 degree. The RSI and MACD indicators have moved into the shopping for zone, suggesting that the likelihood of a sustained uptrend is excessive.

On the draw back, Ethereum’s quick assist is on the $1,577 mark. A break under this degree has the potential to push the ETH value towards the $1,500 mark.

Purchase ETH Now

High 15 Cryptocurrencies to Watch in 2023

Traders within the cryptocurrency market have many choices past Bitcoin (BTC) and Ethereum (ETH). The Cryptonews Trade Speak workforce has compiled an inventory of the highest 15 altcoins to look at in 2023.

The checklist is usually up to date with new ICO initiatives and altcoins, so be certain to examine again often for the newest additions.

Disclaimer: The Trade Speak part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

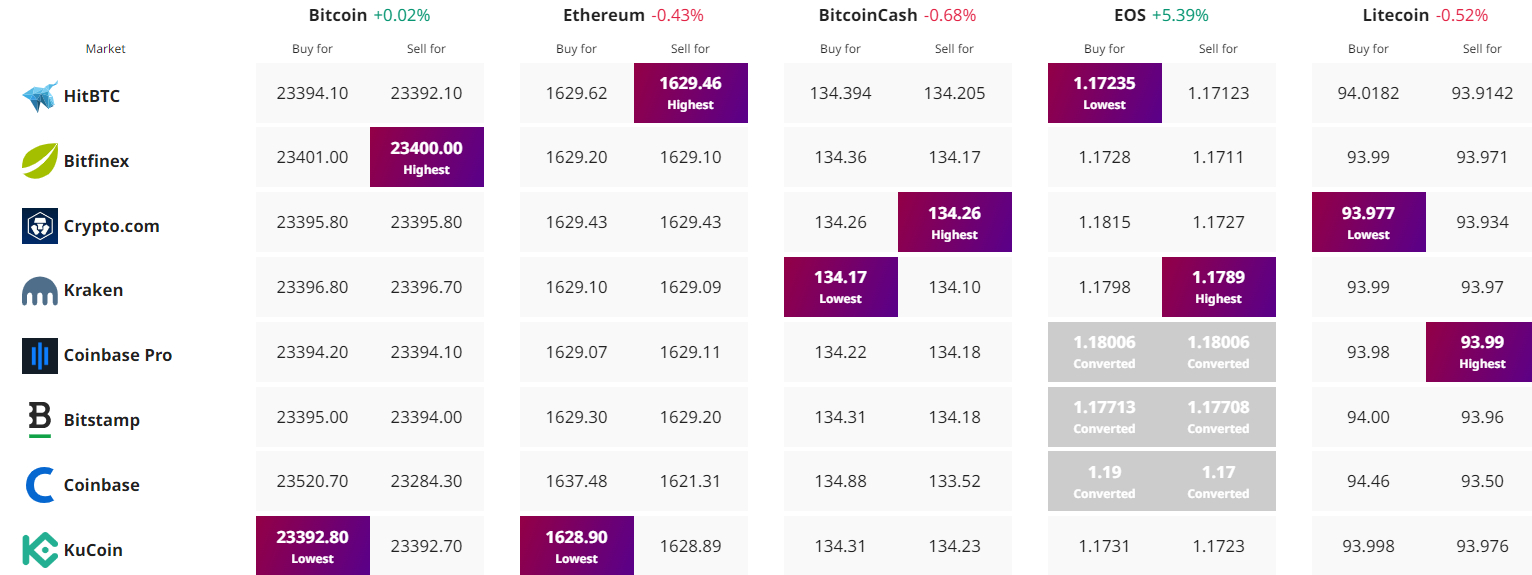

Discover The Finest Worth to Purchase/Promote Cryptocurrency