Andriy Onufriyenko/Second by way of Getty Pictures

When investing in bitcoin (BTC-USD) as an asset, or firms that construct on prime of the Bitcoin community as a part of an asset combine, we want some set of metrics with which to judge the progress of the funding thesis, and by extension, the well being of the Bitcoin community.

It is greater than only a worth on a chart; it is an open-source community with thousands and thousands of customers, 1000’s of builders, a whole bunch of firms, and a number of other ecosystems constructed on prime of it. Most Wall Road analysts and retail traders have not truly used a bitcoin pockets, taken self-custody of the asset, despatched it to others, and/or used it in varied ecosystems, and but doing so could be very useful for elementary analysis.

Bitcoin means lots of various things to lots of totally different folks. It permits moveable financial savings, censorship-resistant international funds, and immutable knowledge storage. For those who’re an American or European investor in top quality shares and bonds, and should not fascinated about the Bitcoin community from the attitude of a Nigerian, Vietnamese, Argentinian, Lebanese, Russian, or Turkish middle-class saver for instance, then you definately’ve not but basically analyzed the asset’s use case.

And on prime of that, folks assess the well being of the community in a number of alternative ways. If Bitcoin would not conform to what they need it to be, they may conclude that it is not doing nicely. However, if Bitcoin matches precisely with what they need, then they may suppose it is doing nice even when there are many frictions remaining to be solved.

Having spent lots of time learning financial historical past, in addition to spending time within the startup/enterprise house round Bitcoin and learning the technical particulars of the protocol lately, I’ve a handful of key metrics that I personally take a look at when assessing the well being of the Bitcoin community. This text walks via them and sees how the community is doing by way of each.

1) Market Capitalization and Liquidity

Some folks say worth would not matter. “1 BTC = 1 BTC” is how they wish to put it. It isn’t bitcoin that’s risky; it is that the world is risky round bitcoin, man.

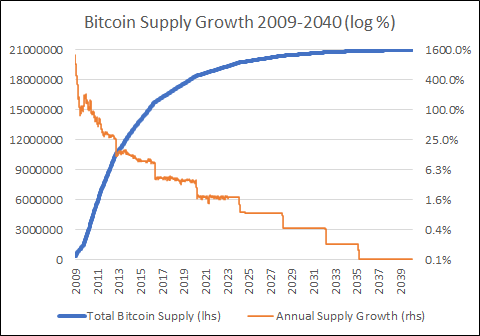

And there is certainly some reality to that. Bitcoin has a completely diluted provide of 21 million bitcoin (technically 2.1 quadrillion sats, that are the smallest denomination of on-chain bitcoin), created and distributed in a pre-programmed reducing sample, produces blocks on common each ten minutes due to an automated problem adjustment, and has operated with outstanding consistency since its inception with a better uptime fee than Fedwire. I do not know what the greenback provide can be subsequent yr, however I do know what the bitcoin provide can be and might straight audit its actual provide at any time.

Damaged Cash

However worth is an necessary sign. It doesn’t suggest a lot on a day-to-day, week-to-week, and even year-to-year foundation, nevertheless it actually means one thing throughout a number of years. The Bitcoin community itself is perhaps serving as a heartbeat of clockwork order in a world of chaos, however worth is nonetheless a measure of its adoption. Bitcoin is competing within the international market of monies now, in opposition to greater than 160 totally different fiat currencies, gold, silver, and varied different cryptocurrencies. As a retailer of worth, it is also competing with non-monetary property like equities and actual property or different issues we will personal with our restricted sources.

It is probably not that the greenback is fluctuating in worth round bitcoin as some proponents wish to say. Bitcoin is the youthful, extra risky, much less liquid, smaller community in comparison with the greenback; it is certainly the one fluctuating extra in worth. In some years, bitcoin holders should buy much more property, meals, gold, copper, oil, S&P 500 shares, {dollars}, rupees, or no matter else in comparison with what they might purchase within the prior yr. In different years, they’ll purchase loads much less. Bitcoin’s worth is especially what’s fluctuating on any given intermediate-term foundation, and the truth that it fluctuates impacts the buying energy of the holders. Thus far, the fluctuations have aimed sharply up, that means {that a} holder of bitcoin should buy much more than they might a number of years in the past.

If worth stagnates for a very long time, that is a chunk of knowledge. If that had been to occur, we should always moderately ask why Bitcoin is failing to attraction to folks. Is it not offering options to their issues? If not, why?

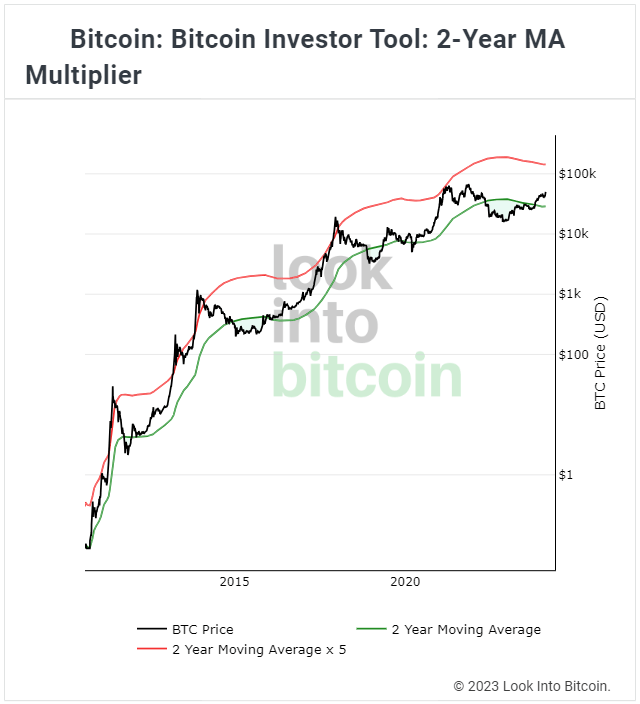

Look Into Bitcoin

Luckily, because the chart above exhibits, that has not been the case. Bitcoin’s worth retains making greater highs and better lows, cycle after cycle. It is one of many best-performing property in historical past. And I’d say it has held up reasonably nicely given the aggressive tightening of central financial institution steadiness sheets and the sharp rise in constructive actual charges over the previous couple of years. on-chain indicators, its historic correlation with international broad cash provide, and different components, Bitcoin continues to get pleasure from long-term adoption and development. However it have to be monitored.

After which there’s liquidity. How a lot each day buying and selling quantity is occurring on exchanges? How a lot transaction worth is being despatched round on-chain? Cash is essentially the most saleable good. Liquidity is essential.

Bitcoin has been rating very nicely on this metric too, with billions or tens of billions of {dollars} value of each day buying and selling quantity in opposition to different currencies and property, which places it on par with Apple (AAPL) inventory by way of each day trade liquidity. And in contrast to Apple the place the overwhelming majority of quantity is on the Nasdaq trade, bitcoins commerce in lots of exchanges and currencies around the globe together with some peer-to-peer marketplaces. There are additionally billions of {dollars} value of on-chain switch quantity in a given day.

A manner to consider liquidity (and it will doubtless make you extra bullish if you understand it), is that liquidity begets extra liquidity. For cash, that is an enormous piece of what the community impact is.

When bitcoin had 1000’s of {dollars} value of buying and selling quantity per day, somebody could not put one million {dollars} into it, even unfold out over weeks, with out drastically shifting the value. It wasn’t an enormous and liquid sufficient marketplace for them but.

After which when bitcoin had thousands and thousands of {dollars} value of buying and selling quantity per day, somebody could not put a billion {dollars} into it, even unfold out over weeks.

And now that bitcoin has billions of {dollars} of buying and selling quantity, there are trillion-dollar swimming pools of capital that may’t put significant percentages into it; it is nonetheless too small and illiquid for them. If they begin placing just a few hundred million {dollars} or a pair billions of {dollars} per day into it, that is sufficient to tilt the provision/demand towards the purchase aspect and critically inflect the value upward. Since inception, the Bitcoin ecosystem has needed to obtain sure ranges of liquidity earlier than it even will get on the radar of larger swimming pools of capital. It is like leveling up.

So, who would purchase bitcoin when it is over $100k or $200k per coin? Entities that cannot actually purchase it till it is that huge, is who. And at $100,000 per bitcoin, every sat is value a tenth of a cent.

Sort of like how the value of a 400 ounce gold “good supply bar” would not actually matter for most individuals, the value of every full bitcoin (an arbitrary giant unit) would not actually matter. What issues is total community measurement, liquidity, and performance. And what issues is whether or not their share of the community is preserving or rising its buying energy over the long term, or not.

Like several asset, bitcoin worth is a perform of provide and demand.

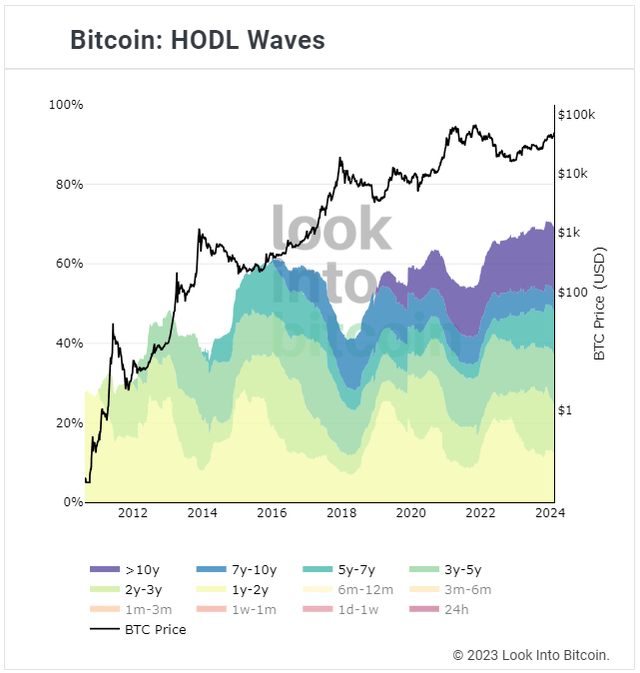

Provide is fastened, however parts of it may be in weak palms or sturdy palms at any given time. Throughout bull markets, lots of new folks excitedly purchase in, and a few longer-term holders trim their publicity and promote to these new consumers. Throughout bear markets, lots of latest consumers promote out at a loss, and the extra steadfast folks maintain dollar-cost averaging into it, hardly ever if ever promoting. Provide rotates from fast-money weak palms to vaulted-money sturdy palms that will not simply half with it. This chart exhibits the proportion of bitcoin that hasn’t moved on-chain in over a yr, together with the value of bitcoin:

Look Into Bitcoin

When bitcoin’s provide is tight like that, it solely takes a small spark of latest demand and recent capital inflows to boost the value considerably, since there will not be an enormous provide response perform from current holders. In different phrases, even a pointy worth improve will not encourage a lot promoting from these 70%+ of cash which have been held for over a yr. However the place does that demand come from?

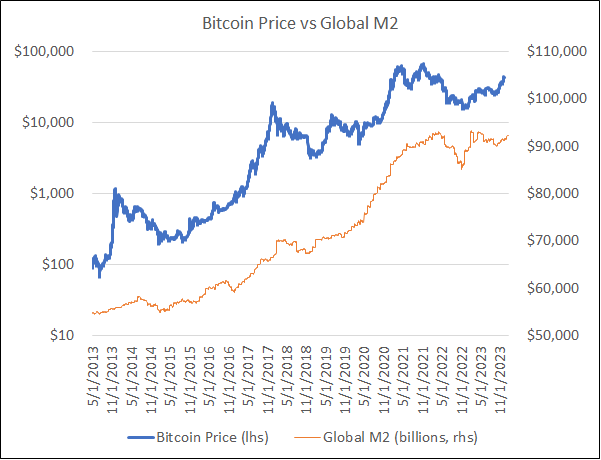

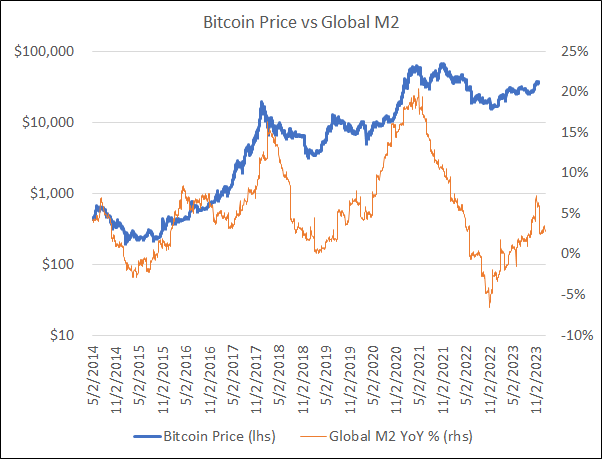

Usually talking, the most important correlation I’ve discovered to bitcoin demand is international broad cash provide, denominated in {dollars}. The primary half, international cash provide, is a measure of world credit score development and/or central financial institution money-printing. For the second half, the rationale greenback denomination is necessary right here is as a result of the greenback is the worldwide reserve foreign money and thus the first unit of account for international commerce, international contracts, and international money owed. When the greenback strengthens, it hardens the money owed of varied nations. When the greenback weakens, it softens the money owed of varied nations. International dollar-denominated broad cash is sort of a huge liquidity metric for the world. How rapidly are fiat foreign money items being created? And the way sturdy is the greenback relative to the remainder of the worldwide foreign money market?

Look Into Bitcoin has a macro suite and as a part of that, they present the speed of change of bitcoin worth relative to the speed of change of world broad cash, and I’ve made a customized chart set out of it:

Lyn Alden, Look Into Bitcoin Lyn Alden, Look Into Bitcoin

Principally, we’re evaluating the trade fee between two totally different currencies right here. Bitcoin is smaller, however is getting more durable over time due to its ongoing provide halvings and its provide cap of 21 million cash. The greenback is manner larger, and goes via durations of softening and hardening, however principally it’s softening and ever-increasing in provide with briefer durations of cyclical hardening. Each the basics of bitcoin and the basics of the greenback (international liquidity) have an effect on the trade fee between the 2 over time.

So when I’m assessing the market capitalization and liquidity of the Bitcoin community, I’m doing it in relation to international broad cash and different main property over time. It is fantastic for it to have main ups and downs; in spite of everything it’s bootstrapping from zero to who is aware of what, and that comes with volatility. Value appreciation attracts leverage, which finally causes crashes. Bitcoin has to maintain going via cycles and shaking off leverage and rehypothecation if it will turn out to be extensively adopted.

Bitcoin’s infamous volatility is unlikely to decrease a lot till it is extra liquid and extra widely-held than it’s now; there is not any repair for bitcoin’s volatility aside from extra time, extra adoption, extra liquidity, extra understanding, and higher person expertise with the wallets, exchanges, and different functions. The asset itself is barely altering slowly; it is the world’s notion of it and the leverage constructed on prime of it or ripped away from it that goes via manic and depressive cycles.

What would make me involved? If the bitcoin worth had been to stagnate regardless of a protracted interval of rising international liquidity, or if bitcoin had been to fail to maintain making greater highs and better lows over a multi-year timeframe regardless of international liquidity doing so. We might then must ask tough questions on why the Bitcoin community is failing to take market share for a protracted time frame. Thus far, it is fairly wholesome by this metric.

2) Variety of Conversion Factors

Bitcoin has gone via quite a lot of narrative transitions over its 15-year lifecycle, though the humorous factor is that nearly all of them had been mentioned by Satoshi Nakamoto, Hal Finney, and plenty of others again in 2009 and 2010 on the unique Bitcoin Discuss boards. However since then, the market has bounced round to emphasise totally different use circumstances of the community over time.

It is just like the parable of the blind males and an elephant. Within the parable, three blind males are all touching an elephant; one touches the tail, one touches the aspect, and one touches a tusk. All of them aggressively argue with one another over what they’re touching, when in actuality they’re all touching totally different components of the identical factor.

An enormous narrative that bounces forwards and backwards within the Bitcoin ecosystem is whether or not it is a fee methodology or financial savings methodology. The reply after all is each, however the emphasis tends to alter generally. Nakamoto’s authentic whitepaper was about peer-to-peer digital money, though in his early posts he additionally talked about central financial institution financial debasement and the way bitcoin is proof against that as a consequence of its fastened provide (i.e. helpful as financial savings). Cash does serve a number of roles, in spite of everything.

Do I contradict myself?

Very nicely then I contradict myself,

I’m giant, I include multitudes.

-Walt Whitman

Each funds and financial savings are necessary, and each features strengthen one another. And since Bitcoin is especially designed as a low-throughput community (which maximizes for decentralization), it primarily serves as a settlement community. Precise day-to-day coffee-scale transactions should be performed on greater layers of the community.

-Bitcoin’s capability to be despatched from any web person to another web person on the planet is a vital a part of what makes it helpful. It gives the one holding it with the potential to make permissionless, censorship-resistant funds via factors of friction. In reality, one of many first-ever use circumstances for it was nicely over a decade in the past when Wikileaks was de-platformed by main fee platforms. Wikileaks then turned to bitcoin to proceed receiving donations. Democracy advocates and human rights advocates in authoritarian regimes have made use of it by bypassing financial institution freezes and so forth. Individuals have used it to evade unjust capital controls that attempt to maintain them completely locked right into a quickly debasing creating nation foreign money.

-Equally, bitcoin’s 21 million provide cap and its decentralized immutability that retains its ruleset credible (together with that offer cap) is what makes it enticing to carry. Most monies improve in provide over time with no restrict, and even refined gold will increase in provide by a mean of about 1.5% per yr, however bitcoin finally doesn’t. If folks did not need to maintain it, and as a substitute simply transformed forwards and backwards from fiat foreign money to bitcoin briefly to make settlements/funds, then that might add all kinds of frictions, prices, and exterior factors of censorship for the community. Paying with bitcoin or receiving fee in bitcoin works greatest if you truly need to maintain bitcoin for the long run as nicely.

So, it is that mix of each funds and financial savings that’s necessary. The important thing manner to consider that is optionality. For those who maintain bitcoin for the long term, you might have the possibility to deliver that portion of your wealth with you anyplace on the planet, or to make permissionless, censorship-resistant funds to any internet-connected particular person on the planet if you wish to or have to. Your cash cannot be unilaterally frozen or debased by any financial institution or authorities with a stroke of a pen. It isn’t caught in a single jurisdiction inside slender borders; it is international. These options won’t appear necessary to many People, nevertheless it’s big for lots of people on the planet.

Many nations place capital positive factors taxes on bitcoin (and most different property), that means if folks promote or spend it, they must pay taxes relative to their price foundation, and so they must maintain observe of the accounting for that. That is an enormous piece of how nations keep their foreign money monopolies. Over time, that may go away for bitcoin because it turns into extremely adopted and as some nations make it authorized tender. However that taxation is the truth for many locations now, and that makes it much less enticing to spend in comparison with fiat foreign money in lots of contexts. That contributes to me not significantly desirous to spend mine a lot, but. However then once more, I am in a jurisdiction and line of labor the place I hardly ever run into home fee frictions with my fiat programs.

Gresham’s legislation states that given a set trade fee (or I’d argue, another friction as nicely like a capital positive factors tax), folks will spend the weaker cash first and hoard the stronger cash. In Egypt, for instance, if somebody has U.S. {dollars} and Egyptian kilos, they’re going to spend the Egyptian kilos and maintain the U.S. {dollars} tucked away as financial savings. Or if every of my bitcoin transactions has a tax on it and my greenback transactions don’t, I am going to often spend the {dollars} and maintain my bitcoin. The Egyptian may spend the {dollars} and I may spend my bitcoin in lots of circumstances, however we’re selecting to not.

Thiers’ legislation states that when a cash will get extraordinarily weak past a sure level, retailers will not settle for it anymore, and so they’ll as a substitute demand fee within the stronger cash. That is when Gresham’s legislation will get overridden, and folks must spend their stronger cash. When a foreign money completely fails, these individuals who have been saving in {dollars} in these nations have a tendency to start spending them, with the greenback and different monies taking on the weaker foreign money even within the medium of trade function.

And in most financial environments, it is not simply retailers promoting items and providers that matter. It is also foreign money brokers. In Egypt or many creating nations, a random service provider like a restaurant won’t settle for {dollars}, though {dollars} are treasured issues that go for a premium inside the nation. Generally it’s worthwhile to convert to the native foreign money first so as to spend at an official service provider. Much less official retailers are sometimes extra readily accepting of premium types of fee.

Suppose I deliver a wad of bodily U.S. {dollars}, a pair South African Krugerrand gold cash, or some bitcoin with me to a random nation, and I do not deliver my Visa playing cards. How may I purchase native items and providers? I can both discover a service provider to simply accept a type of monies straight, or I can discover a dealer that may convert these more durable monies to native foreign money for me on the truthful native worth. For that latter methodology, it is like I am getting into an arcade or on line casino; I would have to convert my actual globally salable cash to this place’s centralized monopoly play cash whereas I am right here, after which convert again out to actual globally salable cash once I depart. It sounds harsh however that is how it’s.

In different phrases, what we have to know is how salable or convertible a kind cash is; not simply what number of retailers straight settle for it or how a lot service provider quantity is being performed in a given foreign money. For a transparent instance, the quantity of individuals paying for issues straight in gold all through the world is extraordinarily low, and but the liquidity and convertibility of gold is excessive; you’ll be able to fairly simply discover a purchaser for a recognizable gold coin at truthful market costs virtually anyplace. Subsequently, gold provides the holder fairly a little bit of optionality. Bitcoin is comparable in that regard, however far more globally moveable.

Most fiat currencies are extraordinarily liquid and salable in their very own nations, accepted by nearly all retailers. However all fiat currencies aside from the highest handful rapidly lose salability and convertibility outdoors of their borders; outdoors of their enforced monopolies. On this sense, they’re like arcade tokens or on line casino chips.

To roughly quantify issues:

-The bodily U.S. greenback has 10/10 salability in america, 7/10 salability in some nations, and perhaps 5/10 salability in different nations. There is a vary, however total it is typically essentially the most salable cash on the planet at the moment. Generally you’ll be able to straight spend it, different occasions it’s a must to convert it first, however both manner, there tends to be loads of liquidity.

-Most bodily currencies even have 10/10 salability in their very own nations, however they’ve both 1/10 or 2/10 salability in all places else. It will take fairly some time and doubtlessly a steep low cost fee to search out somebody who will trade worth for them when they’re outdoors of their host jurisdiction. Like an arcade token.

-Gold has most likely like 6/10 salability virtually in all places, which makes it one of many extra salable bearer property round, up there with the greenback. You may’t spend it as simply as a rustic’s native fiat foreign money, and little or no spending quantity occurs with it total, however in nearly any nation you’ll be able to trade it for liquid worth simply. Gold is a globally-recognized liquid and fungible type of worth.

-Bitcoin has one thing like 6/10 salability in lots of city facilities of the world, much like gold in that sense, nevertheless it drops right down to 2/10 or so in lots of rural areas, much like fiat currencies outdoors of their monopoly borders. However it’s on a powerful uptrend, and it has come that removed from nothing in simply 15 years. Plus, it will also be transformed on-line in most nations to cell phone knowledge top-ups, digital reward playing cards which might be spendable regionally, and different types of worth, so the general variety of offline and on-line conversion factors for those who deliver their bitcoin round with them is substantial.

The precise query to ask in my view is “If I deliver bitcoin with me, may I spend or convert it for worth with out a lot problem?” In city facilities of many nations, like South Africa or Costa Rica or Argentina or Nigeria as creating nation examples, or mainly any developed nation, that is a reasonably resounding sure. In different nations like Egypt, it is probably not there but. So what we have to monitor is the final route.

Thus far, bitcoin is certainly changing into extra salable/convertible over time in any given multi-year time interval.

The Rise of Bitcoin Hubs

In my opinion, essentially the most promising pattern is the expansion of many small bitcoin communities around the globe. El Zonte in El Salvador was among the many first, and it triggered the president of the nation to note it and make it authorized tender throughout the entire nation. However it additionally sparked different communities like Bitcoin Jungle in Costa Rica, Bitcoin Lake in Guatemala, Bitcoin Ekasi in South Africa, Lugano in Switzerland, F.R.E.E. Madeira, and plenty of others which have turn out to be dense areas of bitcoin utilization and acceptance. The salability and convertibility in these locations and others are each reasonably excessive. These hubs simply maintain popping up.

As well as, Ghana has hosted the Africa Bitcoin Convention run by a lady named Farida Nabourema for 2 years in a row. She is an exiled democracy advocate from Togo who’s deeply conversant in monetary repression as a device for authoritarianism, and can be a critic of France’s neocolonialist ongoing financial association in over a dozen African nations. As well as, Indonesia now has a recurring bitcoin convention run by a lady named Dea Rezkitha. There are conferences in nations all around the globe.

And there are small organizations like Bitcoin Commons in Austin Texas, Bitcoin Park in Nashville, Pubkey in New York, and Actual Bedford in the UK, that function native bitcoin hubs. It is changing into more and more frequent that in a given metropolis, there’s a devoted bitcoin neighborhood or recurring meet-up there.

There are additionally apps that allow you to discover bitcoin retailers in your space, which in some circumstances are constructed into pockets apps. BTCMap.org for instance enables you to discover retailers around the globe that settle for bitcoin. And there are actually wallets with AI assistant APIs constructed into them, permitting folks to entry ChatGPT and related functions by paying microtransactions denominated in fractional bitcoin per query reasonably than a full subscription, which makes it simpler to afford and simpler for funds to movement throughout borders from anyplace.

3) Technical Safety and Decentralization

My buddy and colleague Jeff Sales space typically makes use of the phrase “So long as Bitcoin stays safe and decentralized,” earlier than describing his future outlook on the asset and its macroeconomic implications. In different phrases, it is an if/else view that rests on the caveat that the community continues to function roughly because it has for the previous 15 years, and that the traits that make the Bitcoin community useful proceed to persist into the longer term.

Bitcoin is not magic. It is a distributed community protocol. For it to proceed to be useful, it has to perform via opposition and assaults, and needs to be the most effective and most liquid option to do it. The idea of Bitcoin is inadequate to essentially matter for something; it is the actuality of Bitcoin that’s necessary. If Bitcoin suffers from catastrophic hacks or will get captured and centralized and permissioned/censored, then it might stop to supply the use-case that it does now, and its worth can be partially or solely degraded.

Along with community results and related liquidity, the give attention to safety and decentralization is basically what makes Bitcoin totally different from different cryptocurrency networks. It sacrifices efficiency in virtually each different class: velocity, throughput, and programmability, so as to be as easy, streamlined, safe, strong, and decentralized as potential. Its design maximizes for these traits above all else. All further complexity have to be constructed on layers on prime of it, reasonably than embedded into the bottom layer, as a result of embedding these traits into the bottom layer would sacrifice efficiency in these key attributes of safety and decentralization.

Subsequently, monitoring Bitcoin’s stage of safety and decentralization is necessary when constructing or sustaining a long-term thesis on the community’s worth and utility.

Safety Evaluation

Bitcoin has had a really strong safety observe report for an rising open supply know-how, however not a faultless one. Here’s a listing of among the extra notable technical points it has confronted thus far:

In 2010 when it was nonetheless model new and barely had a market worth, the Bitcoin node shopper had an inflation bug, which Satoshi fastened with a delicate fork.

In 2013, a Bitcoin node shopper replace was by accident not backward-compatible with the prior (and extensively used) node shopper as a consequence of an oversight, leading to an unintended chain cut up. Inside hours, builders analyzed the issue and informed node operators to fall again to the prior node shopper, which resolved the chain cut up. Since that point over a decade in the past, the Bitcoin community has loved 100% excellent uptime. Even Fedwire has encountered outages and failed to attain 100% uptime throughout that interval (and doesn’t even try to run 24/7/365 to start with like Bitcoin does).

In 2018, one other inflation bug was by accident added to the Bitcoin node shopper. Nevertheless, this one was recognized and discreetly fastened by builders earlier than it was exploited, and so it by no means brought on a problem in observe.

In 2023, folks started making use of the SegWit and Taproot delicate fork upgrades in ways in which weren’t meant by the builders of these upgrades, together with inserting giant photographs into the signature portion of the Bitcoin blockchain. Whereas this isn’t a bug per se, it exhibits the dangers of how sure features of the code can be utilized in ways in which weren’t meant, and subsequently exhibits the continuing want for conservatism when performing upgrades sooner or later.

Bitcoin suffers from the “yr 2038 downside” that many laptop programs have. Throughout the yr 2038, the 32-bit integer used for Unix timestamping will run out of seconds for a lot of laptop programs, leading to an error. Nevertheless, as a result of Bitcoin makes use of an unsigned integer for this, it received’t run out till the yr 2106. This may be fastened by updating the time to a 64-bit integer or by taking the block top into consideration when deciphering the wrapped-around 32-bit integer, however so far as I perceive it this may increasingly require a tough fork, which implies an improve that’s backward-incompatible. This shouldn’t be laborious in observe as a result of it’s clearly mandatory and will be performed nicely upfront of the issue (years or a long time even), however it might open a window of vulnerability. One potential option to do it might be to launch an replace that’s backward-compatible at first, however that prompts when the integer runs out and thus solves the issue.

–Damaged Cash, Chapter 26

Bitcoin can certainly rebound from technical issues. The fundamental answer is for node operators on the decentralized community to roll again to a previous replace earlier than the bug existed and reject the brand new updates which might be inflicting the issue. Nevertheless, we should think about a worst-case state of affairs. If a technical difficulty goes unnoticed for years and turns into entrenched as a part of the broad node community, and then will get discovered and exploited, then that could be a extra catastrophic downside. It is nonetheless not unrecoverable, however it might be a critical blow.

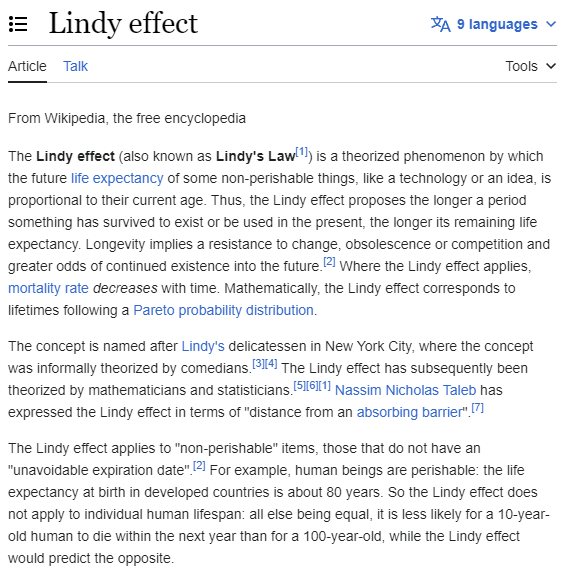

As Bitcoin’s codebase exists over years and a long time, it hardens and advantages from the Lindy impact.

Wikipedia

General, the speed of main bugs has decreased over time, and the truth that the community has had 100% uptime since 2013 is outstanding.

Decentralization Evaluation

For decentralization, we will measure node distribution and mining distribution as key variables. A widely-distributed node community makes altering the community’s guidelines very laborious to do, as a result of every node enforces the principles for its person. Equally, a widely-distributed mining community makes transaction censorship more durable to drag off.

Bitnodes identifies over 17,000 reachable Bitcoin nodes. Bitcoin core developer Luke Dashjr estimates that there are over 70,000 nodes when making an allowance for ones which might be operating privately.

In distinction, Ethernodes identifies about 6,000 Ethereum nodes, of which about half are hosted by cloud operators reasonably than run residentially. And since Ethereum nodes use an excessive amount of bandwidth to run privately by way of Tor, that is most likely near the precise quantity.

So, Bitcoin is reasonably sturdy by way of node distribution.

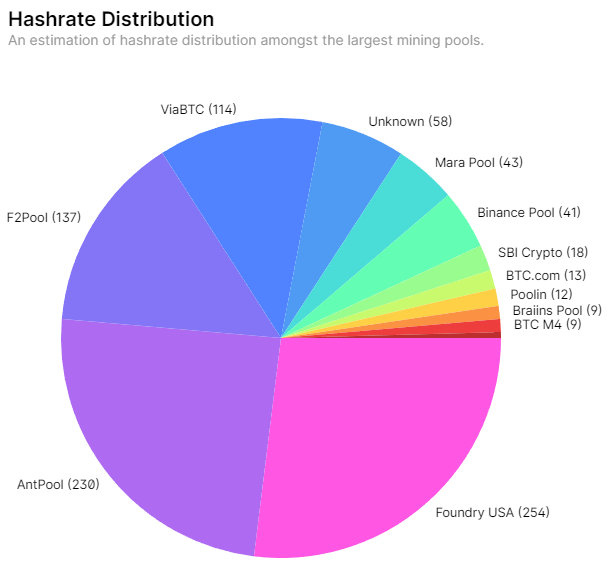

Bitcoin miners can’t change the core guidelines of the protocol, however they’ll decide what transactions make it into the community or not. So, miner centralization can improve the percentages of transaction censorship.

The most important publicly-traded miner, Marathon Digital Holdings (MARA) has lower than 5% of the community hash fee. There are a pair different personal miners roughly on that scale. After which there are numerous private and non-private miners with 1-2% of the community, and plenty of with much less. In different phrases, mining is certainly fairly decentralized; even the biggest gamers have tiny allocations of the community.

Ever since China banned bitcoin mining in 2021, america has been the biggest mining jurisdiction, however is estimated to have lower than half of mining hash fee. China is satirically nonetheless the #2 mining jurisdiction as a result of mining is de facto laborious to stamp out even with their stage of authoritarianism. Different energy-rich nations like Canada and Russia have sizable mining infrastructure, and dozens of nations have small operations.

Mining firms often direct their hashing energy to mining swimming pools. Mining swimming pools are at the moment reasonably centralized, with two swimming pools collectively controlling about half of transaction processing, and the highest ten swimming pools controlling nearly the entire transaction processing. I believe that is an space for enchancment:

Blockchain.com

There are, nevertheless, some necessary caveats. Firstly, mining swimming pools don’t custody the mining machines, which is a essential distinction. If a pool misbehaves, miners can simply change to a different pool. So whereas just a few swimming pools may work collectively to do a short 51% assault on the community, their capability to maintain such an assault is probably going very weak. Secondly, Stratum V2 has been rolling out just lately, which permits miners to have extra management of the block development course of than simply letting the swimming pools do the entire work.

The bodily mining provide chain can be reasonably centralized. Taiwan Semiconductor (TSM) and some different foundries on the planet function the important thing bottlenecks for many kinds of chip manufacturing, together with the application-specific chips that bitcoin miners use. In reality, I’d go as far as to say that I believe pool centralization is an overrated threat, and that semiconductor foundry centralization is an underrated threat.

General, possession of lively mining machines could be very decentralized, however the truth that some nations have a big share of miners, that sure swimming pools have lots of mining energy directed at them, and the mining provide chain has some centralized features, chips away at that mining decentralization to a average diploma. I believe mining is an space that might profit from extra growth and a spotlight though crucial mining variable (the possession and bodily distribution of electrified mining machines) is luckily very decentralized.

4) High quality of Person Expertise

If Bitcoin is tough to make use of technically, then it primarily will get restricted to programmers, engineers, ideologues, and energy customers which might be prepared to place in time to be taught it. However, if it is practically easy to make use of, it could unfold to folks extra simply.

Once I checked out cryptocurrency exchanges again in 2013-2015, they had been very sketchy trying. These days it is typically simpler to purchase bitcoin on respected exchanges and brokers, and with easy interfaces. And again within the early days, there have been no devoted bitcoin {hardware} wallets; folks had to determine how one can handle their keys on their very own computer systems usually. Many of the “misplaced bitcoins” you hear about within the media had been from that early period, when bitcoin was not useful sufficient for folks to pay shut consideration, and when keys had been more durable to handle.

Over the previous decade, {hardware} wallets have turn out to be extra widespread and simpler to make use of. Software program wallets and interfaces have additionally improved loads as nicely.

Considered one of my favourite latest combos is the Nunchuk+Tapsigner combo, which works nicely for modest quantities of bitcoin. The Tapsigner is a $30 NFC card pockets that may maintain personal keys offline inexpensively, whereas Nunchuk is a free cell or desktop pockets that may work with many {hardware} pockets sorts together with Tapsigners for average quantities of bitcoin or full-feature {hardware} wallets for bigger quantities of bitcoin.

Many years in the past, studying to make use of a checkbook was an necessary ability. These days, many younger folks get bitcoin/crypto wallets earlier than they get financial institution accounts. Managing public/personal key pairs is prone to turn out to be a extra routine a part of life, each for managing cash and for signing issues to distinguish actual social content material from pretend content material. It is simple to be taught, and many individuals will develop up with the know-how round them.

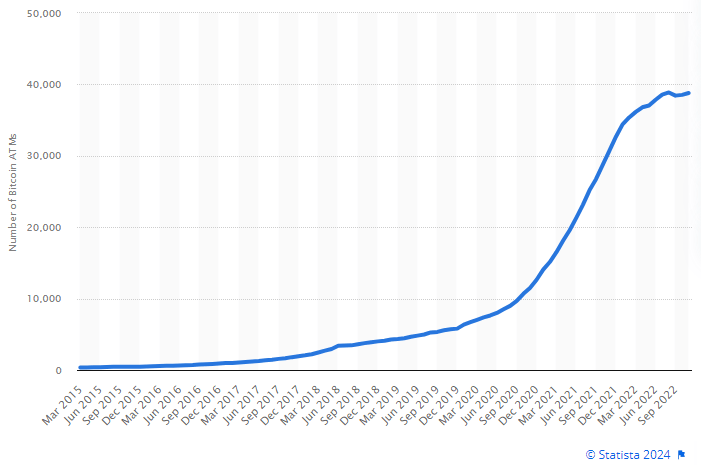

The variety of bitcoin ATMs on the planet in keeping with Statista additionally elevated by an element of greater than 100x from 2015 to 2022:

Statista

And alongside ATMs, there was an increase in voucher buy strategies, which I believe is likely one of the the reason why the ATM numbers began to flat-line just lately. Azteco was based in 2019, and in 2023 they raised $6 million in seed capital in a funding spherical led by Jack Dorsey. Azteco vouchers will be bought for money at a whole bunch of 1000’s of retail factors and on-line platforms, significantly throughout creating nations, after which redeemed for bitcoin.

The Lightning community ramped up over the previous six years, and reached very usable ranges of liquidity by late 2020.

Web sites like Stacker Information and communication protocols like Nostr additionally built-in the Lightning community, and this in the end blends worth switch with info switch. Browser plug-ins like Alby are pretty new, and have made it simple to make use of Lightning on a number of web sites from one pockets, and can be utilized as a sign-on methodology for a lot of of them as a substitute of a username/password mixture.

Satoshi Roundtable is a recurring business occasion that often finally ends up specializing in altcoin content material loads more-so than bitcoin content material. This yr’s occasion, nevertheless was extensively reported to focus closely on a number of new bitcoin layer-two scaling ideas primarily based on rising know-how reminiscent of BitVM. From speaking to builders and financiers, I’ve seen the same renaissance in concepts and capital flowing into varied new options on the Bitcoin community. A lot of this can doubtless lead to a startup valuation bubble, however after the wash-out that follows, it ought to result in some nice tech that helps enhance person expertise.

General, the Bitcoin community has turn out to be simpler and extra intuitive to make use of over time, and from what I see within the growth pipeline, that may proceed to be the case within the years forward.

5) Authorized Acceptance and International Recognition

“However what if the federal government bans it?” has been a standard objection to Bitcoin since inception. Governments do get pleasure from their state-issued foreign money monopolies and capital controls, in spite of everything.

Nevertheless, when answering that query, we have to ask, “which authorities?” There are about 200 of them. And sport idea is such that if one nation bans it, one other nation can acquire enterprise by inviting folks to come back and construct with them as a substitute. One nation (El Salvador) even acknowledges bitcoin as a authorized tender now. Another nations are utilizing capital from their sovereign wealth funds for bitcoin mining.

Additionally, some issues are simply actually laborious to cease. Again within the early Nineties, Phil Zimmerman created Fairly Good Privateness or “PGP”, which was an open supply encryption program. It allowed folks to ship personal info to one another over the web, which isn’t one thing that almost all governments appreciated. After his open-source code discovered its manner outdoors of america, the U.S. federal authorities launched a felony investigation in opposition to Zimmerman for “munitions export with no license”.

In response, Zimmerman revealed his full open-source code in a e-book, which gave it safety beneath the First Modification. It was, in spite of everything, only a assortment of phrases and numbers that he selected to specific to others, or speech in different phrases. Some folks together with Adam Again (the creator of Hashcash, which finally was used inside Bitcoin as its proof-of-work mechanism) even started placing varied encryption code on T-shirts, with the warning on the T-shirt that the shirt was labeled as munitions and thus unlawful to export or present to a overseas nationwide.

The U.S. federal authorities certainly dropped their felony investigation of Zimmerman, and encryption rules had been reformed. Encryption grew to become a key a part of e-commerce, since paying on-line requires safe encryption, and thus lots of financial worth may have been delayed or pushed elsewhere if the U.S. federal authorities had tried to persist past what was possible.

These kind of protests had been profitable in different phrases, and used the rule of legislation in opposition to authorities overreach, and likewise pointed to the absurdity and infeasibility of making an attempt to limit such concise and easily-spreadable info. Open-source code is simply info, and knowledge is tough to suppress.

Equally, Bitcoin is free open-source code, which makes it laborious to stamp out. Even proscribing the {hardware} aspect is hard; China banned Bitcoin mining in 2021 however China continues to be the second largest mining jurisdiction. When China has hassle banning one thing, it is clearly not simple to ban. The software program aspect is even stickier than that.

A whole lot of nations have flip-flopped on banning Bitcoin, or bumped into their very own rule of legislation or division of energy. In comparatively free nations, authorities is just not a monolith. Some authorities officers or representatives like Bitcoin, whereas others don’t, and they’re accountable to the folks and to the rule of legislation.

-In 2018, India’s central financial institution banned banks from interacting with cryptocurrencies, and lobbied the federal government to ban cryptocurrency use solely. However in 2020, India’s supreme court docket dominated in opposition to them, which restored rights of the personal sector to innovate with this know-how.

-In early 2021, amid a decade of persistent double-digit inflation of their very own foreign money, Nigeria’s central financial institution prohibited banks from interacting with cryptocurrencies, though they did not attempt to illegalize it among the many public as a result of it is actually laborious to implement. As an alternative, they launched the eNaira central financial institution digital foreign money, and clamped down on bodily money with a lot stricter withdraw/ATM limits, to attempt to corral folks into their centralized digital fee programs. Throughout the ban, Chainalysis assessed that Nigeria had the second highest cryptocurrency adoption on the planet (principally stablecoins and bitcoin), and particularly had the best peer-to-peer buying and selling quantity on the planet, which is how they acquired across the financial institution blockage. In late 2023, after practically three years of an ineffective ban being in place, Nigeria’s central financial institution reversed their resolution and opened banks as much as interacting with cryptocurrencies with rules.

-Again in 2022, amid heavy demand for cryptocurrencies by the general public to defend in opposition to triple-digit inflation, a few of Argentina’s main banks had been stepping up efforts to supply them to clients, however Argentina’s authorities banned banks from providing them to clients. They cited the standard headline causes of volatility, cybersecurity, and cash laundering, however actually it was about making an attempt to sluggish the flight out of their failing foreign money. After which in 2023, they went a step additional by additionally banning fintech fee apps from providing digital property to clients. However this began to be reversed after the election of Javier Milei, who’s pro-bitcoin and in favor of the market figuring out what it desires to make use of as cash. Throughout Milei’s marketing campaign, economist Diani Mondino (now Argentina’s Minister of Overseas Affairs) wrote that “Argentina will quickly be a Bitcoin haven.”

-For years, america Safety Change Fee blocked spot bitcoin ETFs. Different nations had spot bitcoin ETFs with no difficulty, and the Commodities Futures Buying and selling Fee allowed bitcoin futures buying and selling, and the SEC allowed futures-based ETFs (each lengthy and brief). The SEC even allowed a leveraged futures bitcoin ETF. However they repeatedly blocked all spot ETFs, which is the only sort and which is what the market wished. In 2023, the D.C. Circuit Courtroom of Appeals discovered that the SEC’s allowance of bitcoin futures ETFs however not spot ETFs was “arbitrary and capricious”, reasonably than primarily based on cheap and coherent arguments. By early 2024, a number of spot bitcoin ETFs started buying and selling.

The mere holding and utilizing of bitcoin places governments in an ungainly place in the event that they attempt to ban it, particularly governments which have any semblance of rule of legislation. They must argue that it is a dangerous factor for there to exist cash that may’t be debased and that individuals can maintain themselves and ship to others. Or one other manner of placing it, they must make the case {that a} decentralized spreadsheet is a menace to nationwide safety, and that such a harmful factor as that have to be banned beneath menace of imprisonment.

As an alternative, the most important authorized challenges for the Bitcoin community forward are doubtless within the space of privateness, and by main governments like america. Governments actually don’t desire folks to have any form of monetary privateness, particularly at scale. Monetary privateness was the default for many of historical past, however in latest a long time it is more and more not.

The premise from their perspective is that so as to stop the 1% of dangerous folks from doing terrorist financing or human trafficking or different dangerous issues, 100% of individuals have to surrender their rights to monetary privateness and permit the federal government to surveil all transactions between all events. As well as, governments have shifted a lot of their income towards revenue taxes, which depend on ubiquitous surveillance of all fee flows to implement. However after all, such a factor can result in large overreach, and with grave penalties.

As well as, we reside in an age of surveillance capitalism. We’re provided myriad free providers by companies if we signal away our digital soul, that means all of our knowledge. What we take a look at, and what we spend on, could be very useful industrial info. And governments improve this and assist make it the norm as a result of they plug into the back-end and accumulate that knowledge too. Generally it might be for nationwide safety causes, and different occasions it might be to attempt to management the entire inhabitants (e.g. China’s social credit score scores).

Nevertheless, the power for folks to self-custody their very own cash, and ship cash to others, and do it in such a manner that companies cannot surveil it and governments cannot surveil it or debase it, is a vital examine on energy. For firms, there are many causes to not need them to surveil us, not least being that they’re typically hacked and spill that knowledge onto the darkish internet. And for governments, reasonably than with the ability to surveil and freeze funds with out possible trigger in a sweeping method in ways in which profit them, these kinds of applied sciences pressure them to have possible trigger earlier than utilizing focused enforcement, which comes with price and authorized process.

Within the nineteenth century and earlier than, monetary privateness was the norm as a result of most exchanges occurred by way of money and cash, and there wasn’t any vital know-how to observe that. The thought of monitoring everybody’s transactions was a kind of science fiction. Beginning within the late nineteenth century and particularly all through the twentieth century, folks more and more used banks for his or her financial savings and funds, and people banks had been more and more centralized and surveilled by governments. The telecommunication age, and the age of recent banking that it contributed to, enabled ubiquitous monetary surveillance to turn out to be regular. Governments principally did not must implement privateness controls on people; they primarily simply needed to implement them on banks, which is straightforward and occurs behind the scenes. The rise of factories and companies introduced folks off of farms and into cities, incomes paychecks that they obtain of their financial institution accounts, with taxes mechanically withdrawn, and with all of their monetary actions simply surveilled.

Nevertheless, as laptop processing, encryption, and telecommunications saved bettering, finally Bitcoin was created and allowed for peer-to-peer pseudonymous worth switch. The extra widespread Bitcoin and adjoining applied sciences turn out to be, and significantly personal layers and strategies on prime of them, the extra untenable it turns into for governments to take care of that current centralized surveillance equipment. Individuals can start opting out, however governments will not make it simple. They’re now making an attempt to impose bank-type surveillance and reporting necessities on people, which is orders of magnitude harder to implement than on establishments.

I believe that there can be extra Zimmerman-like conflicts within the years forward, however this time for monetary privateness. Governments will more and more tighten these frictions round folks utilizing varied privacy-preserving strategies, as much as and together with making an attempt to criminalize them, and the protection to such overreach is that lots of them are open-source. They’re simply info. To limit their creation and their utilization by people who find themselves not in any other case committing crimes, requires criminalizing the utilization of phrases and numbers in a sure order. It is each laborious to legally justify in jurisdictions which have free speech, and laborious to implement in observe as a result of open-source code spreads reasonably simply. And in america and sure different jurisdictions, well-funded lawsuits can push again on these legal guidelines as being unconstitutional. So, I anticipate that interval to be messy.

Last Grade: A-

Grading the community is sort of a joke because it’s probably not quantifiable, however mainly most features of the community are both getting higher or are staying roughly the identical.

Lots of people say that Bitcoin has no fundamentals and is simply primarily based on hypothesis, however those who say that typically are unfamiliar with the tech ecosystem and have not performed lots of work getting in control on it. Such a analysis on the community and ecosystem’s fundamentals is necessary, and is much like doing elementary analysis on any firm to find out whether or not its worth and worth are prone to improve or lower.

The areas the place we will subtract factors and thus deliver it right down to an A- reasonably than an A or A+, is that miner decentralization might be higher (significantly with regard to swimming pools and ASIC manufacturing), and total person expertise and second layer software/ecosystem growth might be additional alongside than it’s now. For that second merchandise, I would wish to see extra and higher wallets, extra seamless utilization of upper layers on the community, extra adoption of built-in privateness options, and so forth, and I do suppose we’re seeing an enormous acceleration there.

If Bitcoin enters a sustained interval of upper charges, because it has been in recently, then I believe that may function one other catalyst for second layer developments will speed up. When charges are low, individuals are extra doubtless to make use of the bottom layer and have much less purpose to make use of higher-layer options. When charges are excessive, varied current use-cases get stress examined, and customers and capital gravitate towards what’s working or what’s being demanded.

Moreover, governments have typically been pulled, generally willingly and generally with protest, towards accepting it to a point. Nevertheless, the battle forward is probably going round privateness, and in my opinion that is nowhere close to being completed but. If something it is simply heating up.

General, I proceed to view the Bitcoin community as being extremely investable, each in bitcoin straight as an asset, and within the fairness of firms constructing on prime of the community.

There are nonetheless areas of threat, however they characterize areas of potential enchancment and contribution. A part of what makes the Bitcoin community highly effective, is that its open supply side makes it in order that anybody can audit the code and suggest refinements to it, anybody can construct layers on prime of it that connect to it, and anybody can construct functions that work together with it and improve it for customers.