In a major milestone for Blur, the beginner NFT market has overtaken OpenSea in each day NFT buying and selling quantity. Blur’s each day commerce quantity hit 6,602 ETH on Wednesday, February 15, crossing OpenSea’s 5,649 ETH for the primary time ever. Furthermore, Ethereum fuel charges are additionally hovering because of the growing commerce exercise. Reportedly, Blur has now surpassed UniSwap and Seaport to turn into the highest “Fuel guzzler” on Ethereum.

Right here’s all it is advisable find out about Blur overtaking OpenSea:

Blur Overtakes OpenSea: What occurred?

A current report by the information analytics platform Nansen.ai discovered that Blur overtook OpenSea in each day buying and selling quantity for the primary time on Wednesday. Apparently, one other analytics platform, Dune, reported a a lot increased distinction in buying and selling volumes between the 2. In keeping with a Dune dashboard by sealaunch.xyz, Blur and OpenSea’s each day buying and selling quantity hit 30,410 ETH and seven,232 ETH, respectively.

On the time of writing, whereas the trades considerably decreased, Blur continues dominating the market with 20,428 ETH. In the meantime, OpenSea is simply at 4,369 ETH.

Reportedly, Blur is presently valued at $1 billion. {The marketplace}’s each day buying and selling quantity grew nearly 4X after it launched its native token, additional cementing it as a powerful OpenSea competitor. Moreover, final week, Blur launched a weblog publish asking its customers to dam gross sales of their NFTs on OpenSea. The transfer got here as a pushback to OpenSea’s earlier choice to ban NFT marketplaces that provide optionally available royalties.

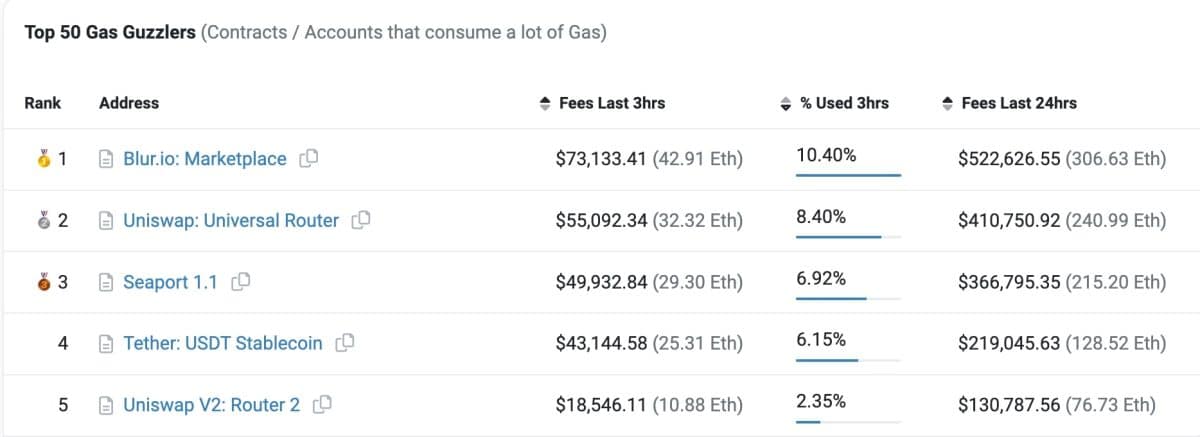

In the meantime, Blur has surpassed Uniswap and Seaport to be the highest Ethereum fuel guzzler (accounts that devour loads of Fuel). That is pure given how NFT buying and selling has considerably gone up on {the marketplace}. And the extra lively the community, the upper its transaction charges.

Why is Blur fashionable?

Firstly, Blur is funded by among the who’s who of the Web3 house, together with Paradigm, Coinbase Ventures & E-GIRL Capital. Then, it provides customers some engaging perks resembling no buying and selling charges. On February 15, it dropped its native token, BLUR, rewarding its most lively customers with token airdrops. Evidently, the airdrop was an amazing success, leading to Blur’s buying and selling volumes hovering considerably.

All in all, Blur airdropped 360 million BLUR tokens. Presently, it boasts an all-time buying and selling quantity of $1.59 billion. In keeping with DappRadar knowledge, {the marketplace} has additionally overtaken OpenSea in 7-day ($435.24 million) and 30-day buying and selling quantity ($711.83 million).

OpenSea vs Blur: The feud defined

For lengthy, OpenSea has been the largest NFT market within the house. Then got here Blur, a royalty-optional market, with a number of engaging options. Amid the creator royalty debate that took steam final yr, OpenSea made a daring transfer: to ban NFT marketplaces that provide optionally available royalties. To elucidate, to get full royalties on OpenSea, creators must cease the sale of their NFTs on royalty-optional marketplaces like Blur.

Nevertheless, with a brand new coverage replace, Blur hit again at OpenSea. The brand new coverage requires its creators to dam their gross sales on OpenSea to get royalties.

Now, Blur appears to be making large leaps. Whether or not it may well preserve the highest spot and topple OpenSea in all-time buying and selling quantity stays to be seen.

All funding/monetary opinions expressed by NFTevening.com usually are not suggestions.

This text is academic materials.

As all the time, make your personal analysis prior to creating any type of funding.