Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Inbox:

The Securities and Alternate Fee as we speak charged Stoner Cats 2 LLC (SC2) with conducting an unregistered providing of crypto asset securities within the type of purported non-fungible tokens (NFTs) that raised roughly $8 million from buyers to finance an animated internet collection referred to as Stoner Cats.

Deep breaths.

Stoner Cats is an “NFT grownup animated quick collection”, which suggests mainly nothing in concept however in follow appears like this:

Pay attention up mfs (my associates): episode 6 comes out December twenty third!! 👵🏼❤️🤶🏼 pic.twitter.com/hgQrvcaE4i

— Stoner Cats (@stonercatstv) December 15, 2022

[please if anyone watches this and recognises the sound at 0:15 when the packet hits the fire let us know it’s driven FTAV insane . . . is it from a video game? arrgghhh.]

A 2021 article by Forbes requested . . .

. . . however didn’t actually make any try to reply that presumably straightforward query. The SEC frames it thusly:

Actor Mila Kunis (whose manufacturing studio Orchard Farm Productions produced this manufacturing) and her himbo husband Ashton Kutcher, the article says, referred to as Stoner Cats a “new mannequin for watching a cartoon TV present a few group of weed smoking felines”. We don’t know what the previous mannequin was.

Anyway, Kunis and Kutcher voiced some cats, whereas Vitalik Buterin (who co-founded Ethereum) additionally performed a personality, blah blah blah the passage of time. Now:

Based on the SEC order, on July 27, 2021, SC2 supplied and bought to buyers greater than 10,000 NFTs for roughly $800 every, promoting out in 35 minutes. The order finds that each earlier than and after Stoner Cats NFTs had been bought to the general public, SC2’s advertising marketing campaign highlighted particular advantages of proudly owning them, together with the choice for house owners to resell their NFTs on the secondary market.

As well as, the order finds that, as a part of the advertising marketing campaign, the SC2 workforce emphasised its experience as Hollywood producers, its data of crypto initiatives, and the well-known actors concerned within the internet collection, main buyers to anticipate earnings as a result of a profitable internet collection may trigger the resale worth of the Stoner Cats NFTs within the secondary market to rise.

Additional, the order finds that SC2 configured the Stoner Cats NFTs to offer SC2 a 2.5 per cent royalty for every secondary market transaction within the NFTs and it inspired people to purchase and promote the NFTs, main purchasers to spend greater than $20 million in a minimum of 10,000 transactions. Based on the SEC’s order, SC2 violated the Securities Act of 1933 by providing and promoting these crypto asset securities to the general public in an unregistered providing that was not exempt from registration.

Carolyn Welshhans, affiliate director of the SEC’s residence workplace, stated:

Registration of securities, together with crypto asset securities, protects buyers by offering them with disclosures to allow them to make knowledgeable investing choices. Stoner Cats needed all the advantages of providing and promoting a safety to the general public however ignored the authorized tasks that include doing so.

The Stoner Cats didn’t land on their toes, and seem to have rolled over:

With out admitting or denying the SEC’s findings, SC2 agreed to a cease-and-desist order and to pay a civil penalty of $1 million.

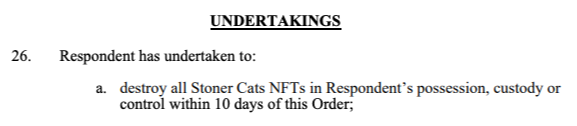

You most likely must snigger, else you’d cry. However Alphaville, which frequently does each, was most interested in this part from the SEC’s order:

Wha . . . ? In addition to the truth that the firm claimed the ten,000 NFTs bought out inside minutes — what is that this speculated to imply? (Nb the SEC used the “destroy” phrase in one other order, in opposition to Influence Principle, final month.)

An NFT, as has been identified advert nauseam, boils right down to a singular identifier saved on a blockchain that factors to a usually digital asset (ie a shitty JPEG), its proprietor, and the related good contract. The asset factor is just referenced by a hyperlink, which may break and is subsequently one among many, many causes NFTs are dumb.

On this context, the one little bit of the NFT that’s intrinsically the NFT is the identifier itself.

However this factor is on the blockchain, which suggests it will probably by no means be destroyed! On the threat of sounding, nicely, stoned, how does one destroy an un-destroyable digital commodity?

The frequent follow on this scenario appears to be to switch the NFT to a pockets that no one controls, and that acts like an enormous communal trash can — a course of referred to as “burning” the NFT. So it’s nonetheless there, however no one can get it.

Will the SEC be proud of this idea of destruction? We’ve requested regulators the query, and can replace if we get a response.