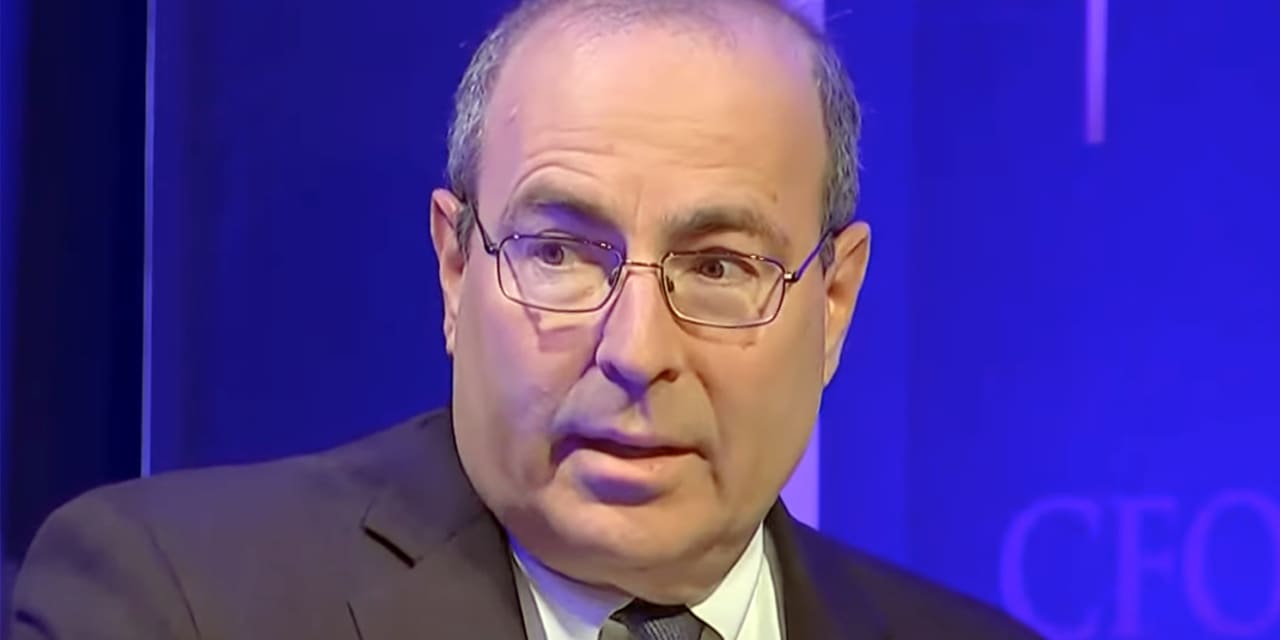

It’s a good suggestion for the Federal Reserve to take its time with interest-rate cuts given all the uncertainty about the place the economic system is headed, Richmond Fed President Tom Barkin stated Wednesday, in an interview with MarketWatch.

“In all honesty, my forecast is unsure. That’s why I believe it’s an affordable concept to be affected person,” Barkin stated.

Barkin stated you should use the financial information to inform credible, however very divergent, tales about the place the economic system is headed.

“I may inform you a narrative of a wholesome economic system and softening inflation, however I may inform you a bunch of different tales, the Richmond Fed president stated.

“I’m extra on this planet of elevated uncertainty.” He stated the forecast he had eight weeks in the past has been “confused” by among the current information.

Barkin, who’s a voting member of the Fed’s interest-rate committee this yr, stated inflation has been coming down properly over the previous seven months. On the similar time, he stated was involved that the numerous decline in items costs seen over that point may be a “head faux” and would possibly rebound in coming months.

Barkin ducked questions of what number of price cuts he expects this yr.

“I don’t have a rate-path focus. I’ve an economic system focus,” Barkin stated.

He stated he was studying and wished to have extra confidence through which of the a number of financial outcomes “we’re headed for.”

If inflation continues on its downward path, and if it begins to broaden out into many classes, “that’s the type of sign I’m on the lookout for” to start out normalizing charges, he stated.

Shares

DJIA

SPX

have been increased in early buying and selling on Wednesday whereas the 10-year Treasury yield

BX:TMUBMUSD10Y

was barely decrease to 4.10%.