Inflation has wreaked havoc on households and companies prior to now few years, however Individuals count on the annual improve in costs to return to shut to prepandemic ranges.

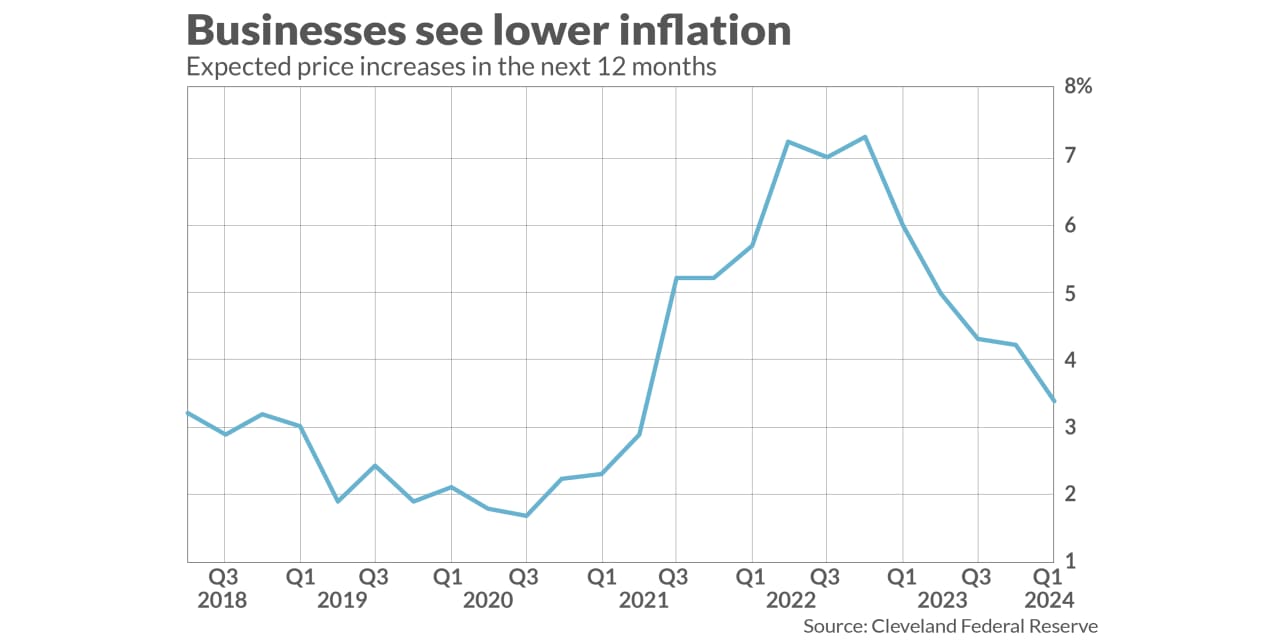

The newest proof to assist their optimism is a four-times-a-year survey by the Cleveland Federal Reserve of enterprise leaders. High executives count on the speed of inflation to taper to a mean of three.4%, utilizing the consumer-price index, within the subsequent 12 months.

The excellent news is, the CPI is already there.

The speed of inflation within the 12 months that resulted in December was already at 3.4%, and it’s anticipated to drop to 2.9% within the January report, due out Tuesday morning.

A greater measure of future inflation, nonetheless, was considerably larger. The core CPI, which omits meals and power, stood at a 12-month price of three.9% on the finish of 2023.

An extended-running survey of customers, in the meantime, additionally discovered that Individuals count on inflation to proceed to decelerate towards prepandemic ranges.

Households count on 2.9% inflation within the subsequent yr, the patron sentiment survey discovered.

What each of those surveys present is that inflation expectations are what the Federal Reserve likes to discuss with as “effectively anchored.” In different phrases, no person expects inflation to maneuver up or down a lot from present ranges.

The Fed, after all, needs inflation to return to 2% a yr. It’s not there but, however the central financial institution’s job can be simpler if customers and companies each suppose it is going to achieve reaching its goal. That’s as a result of inflation expectations — whether or not excessive or low — typically feed on themselves.

Additionally learn: Monetary markets are relying on consumer-price inflation to fall under 3% for first time since 2021

And: Sure, that Massive Mac meal might price $18 — however there’s one good purpose for it