Retail chains are among the many worst affected by the elevated inflation and weakening client confidence. For normal merchandise retailers like Goal Company (NYSE: TGT), the sharp discount in discretionary spending is offsetting the advantages of post-pandemic restoration in retailer visitors. The corporate’s digitally-originated comparable gross sales declined progressively in current quarters, which is evident proof of the reversal of the pandemic-era e-commerce growth.

Final yr, the administration raised the dividend above $1 per share, which at present affords a yield of two.5%. So, TGT can be a very good decide for revenue traders. In the meantime, market watchers are divided of their suggestions for the inventory, reflecting estimates of a sluggish restoration this yr.

After a comparatively weak yr, the corporate’s future prospects would rely on its capacity to strike the correct steadiness between pricing and promotional affords. It additionally must take measures to ease the unhealthy stock build-up.

Learn administration/analysts’ feedback on quarterly reviews

“…Goal’s solely owned manufacturers present great high quality at extremely aggressive costs, an incredible mixture anytime, however by no means extra so than in an inflationary surroundings. So, as we flip our focus to This fall, we’ll do what we at all times do: work tirelessly to ship worth and options to our friends whereas additionally delivering reasonably priced pleasure at a time after they want it most. As we’ve outlined this morning, we’re taking a prudent method to our stock planning and gross sales expectations for the fourth quarter in gentle of the regarding business tendencies we’ve seen over the previous a number of weeks,” stated Goal’s CEO Christina Hennington on the final earnings name.

Goal’s fourth-quarter report is scheduled for publication on February 28 earlier than the opening bell. In keeping with estimates, the underside line continues to be underneath strain from elevated prices, and specialists have stated that earnings greater than halved to $1.40 per share within the January quarter. The weak spot displays an estimated 1% year-over-year decline in gross sales to $30.7 billion. The projection is in step with the administration’s cautious outlook for the quarter.

Financials

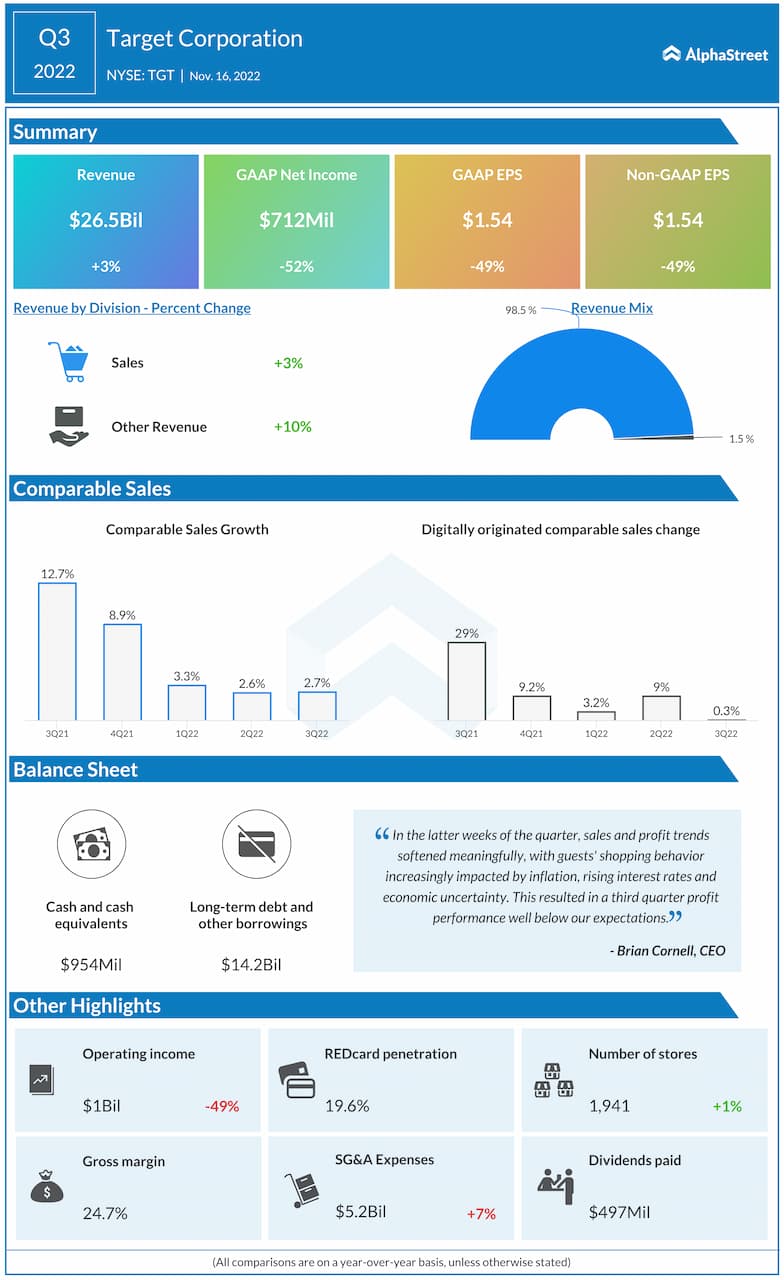

Within the third quarter, a 3% sale development drove up revenues to $26.5 billion, which additionally exceeded the consensus forecast. However that didn’t replicate within the firm’s earnings, which dropped 49% from final yr to $1.54 per share. Extra worryingly, earnings missed the market’s estimates for the third consecutive quarter. Comparable gross sales development decelerated sharply to $2.7% from 12.7% within the corresponding interval final yr.

Earnings: Walmart This fall outcomes beat estimates; US comps up 8.3%

Goal’s inventory opened Tuesday’s session barely under $170. It traded decrease all through the session and misplaced about 3%. Up to now six months, it declined by greater than 15%.