FluxFactory/E+ by way of Getty Pictures

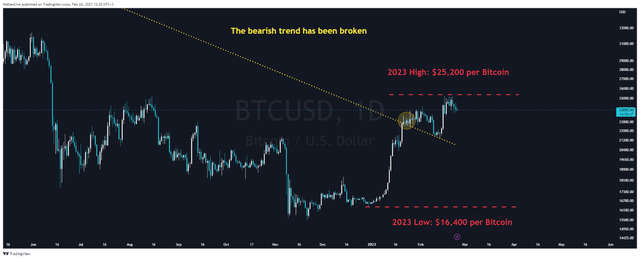

On January 20, 2023, the worth of Bitcoin (BTC-USD) broke via the bearish pattern that had been noticed for fourteen months and thus introduced a contact of optimism to the crypto market. Bitcoin has been consolidating within the $21,500-$25,300 vary for the reason that finish of January, indicating the primary important indicators of market stabilization because the Fed continues to boost rates of interest and enhance geopolitical tensions around the globe on account of a Chinese language balloon coming into US house and elevated hostilities between Russia and Ukraine.

N_Aisenstadt – TradingView

This text will current the components nonetheless exerting downward strain on the worth of cash and never enable speaking a couple of full change from a bearish pattern to a bullish one. Alternatively, an increasing number of indicators in the marketplace point out the start of a restoration in funding curiosity in cryptocurrencies after the devastating information about hacker assaults on crypto exchanges and even the chapter of a few of them within the second half of 2022.

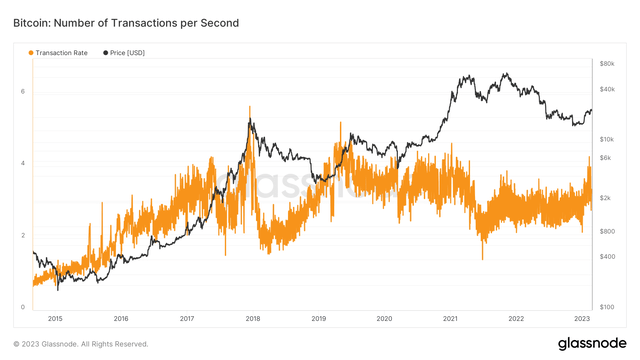

Rising charges within the Bitcoin community

One of many first components which can be starting to level to the transition of the crypto trade from a bearish cycle to a bullish cycle is the rise within the common transaction charge within the Bitcoin community. The important thing cause for the rise in commissions is the rise within the variety of transactions within the Bitcoin community, and in consequence, competitors for inclusion in blocks is intensifying. Consequently, crypto miners are beginning to choose transactions with larger charges to maximise their income for his or her providers.

Supply: Creator’s elaboration, primarily based on Glassnode

After reaching a multi-year excessive in November 2021, the worth of BTC was in a bearish pattern till January 16, 2023. On the similar time, charge income remained extraordinarily low for under 4 months after the worth of Bitcoin reached $65,000 per coin. After many market individuals grew to become disillusioned with cryptocurrencies and apathy reigned, comparatively low costs attracted new merchants and buyers who took benefit of the scenario.

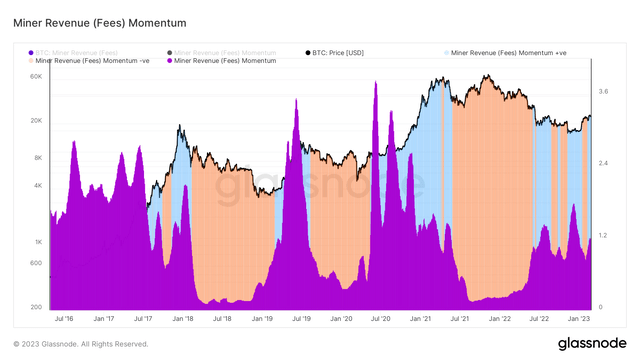

Supply: Creator’s elaboration, primarily based on Glassnode

For the time being, we are able to see the charge momentum breaking above one, indicating a rise in block house demand. Because of this, this not solely results in a restoration in miners’ earnings however may also affirm the emergence of hope amongst crypto group members with the next finish of the crypto winter.

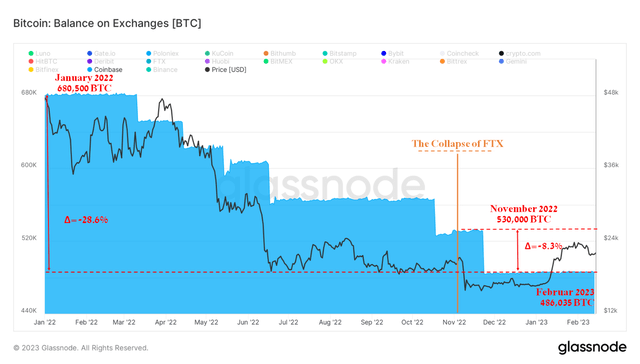

The stability of crypto exchanges continues to say no

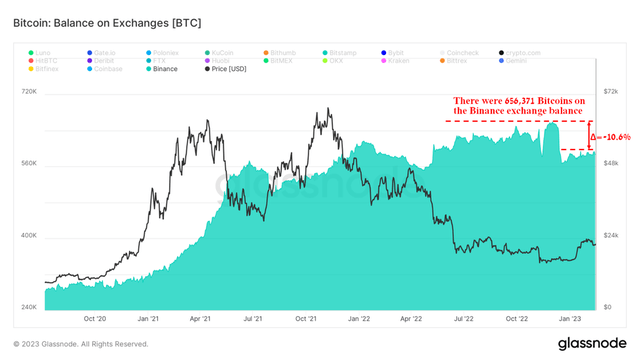

In latest quarters, the cryptocurrency trade has been flooded with information of varied alternate hacks. On October 6, 2022, there have been experiences on many data sources that hackers efficiently hacked the blockchain related to Binance, stealing $566 million in BNB, Ethereum (ETH-USD), Fantom (FTM-USD), Polygon (MATIC-USD), and different cash.

And in mid-January 2023, FTX acknowledged (FTT-USD) in a report back to collectors that $415 million of digital property had been stolen on account of hacking assaults. And in consequence, many buyers started to be extra conservative in holding Bitcoins, Litecoins (LTC-USD), and different cash, shifting them to safer offline crypto wallets. Furthermore, the belief continues to say no in exchanges that had been actively used to conduct transactions with cash till Q3 2022, and in the meanwhile, a lot of their purchasers favor to maintain their property below their management.

On November 22, 2022, the overall variety of Bitcoins held by Coinbase (COIN) was round 531,242, and the following day there was a major withdrawal of funds in extra of 44,000 BTC because of the unfold of opposed experiences in regards to the chapter of FTX. On a bigger scale, there’s a pattern towards decreasing the holding of cash by buyers on the stability sheet of a crypto alternate. So, for the reason that starting of 2022, Coinbase’s purchasers have withdrawn rather less than 195,000 Bitcoins, thereby creating further strain on the monetary place of one of many largest exchanges on this planet.

Supply: Creator’s elaboration, primarily based on Glassnode

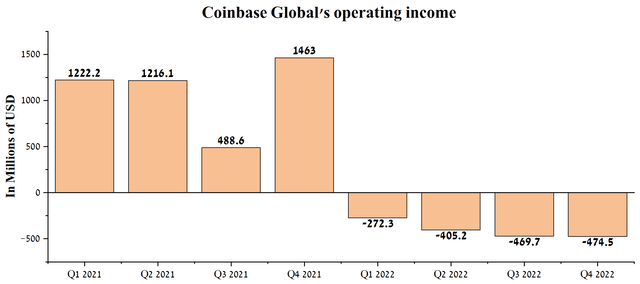

Furthermore, one of many further causes for the discount within the stability of Coinbase would be the want of buyers to take earnings from their investments because of the enhance within the worth of Bitcoin by simply over 40% over the previous month and a half. Total, in This autumn 2022, the corporate posted an working lack of $474.5 million, starkly contrasting to the final three months of 2021, throughout which Coinbase posted its highest working earnings ever. The continued downward pattern in working earnings from quarter to quarter is a pink flag and could be a important trigger for concern for buyers and the whole crypto group.

Supply: Creator’s elaboration, primarily based on Searching for Alpha

As well as, Binance’s associate in issuing Binance USD, Paxos, is below the gun. The U.S. Securities and Alternate Fee has begun a dialogue with Paxos about the necessity to change the authorized standing of this stablecoin, and the regulator can be contemplating steps in opposition to the corporate. Within the occasion that Binance USD (BUSD-USD) is acknowledged as a safety, this may open Pandora’s field, because of which many different stablecoins can obtain this standing, which can result in extra stringent regulation and lack of curiosity by merchants and buyers within the crypto trade. You possibly can already see how the stability of Bitcoin at Binance (BNB-USD) has decreased by 10.6% from the height within the 4th quarter of 2022.

Supply: Creator’s elaboration, primarily based on Glassnode

Fed fee hike

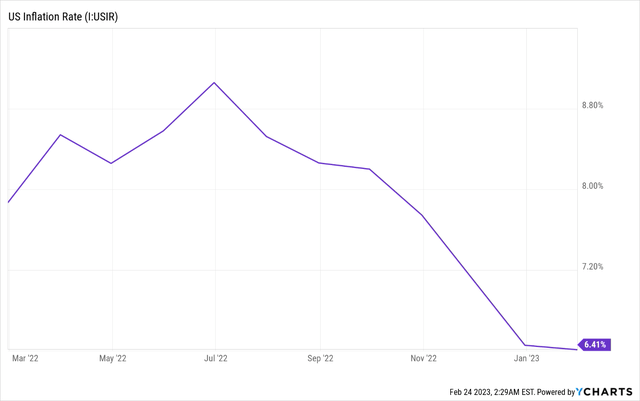

On the Federal Open Market Committee assembly, which was held from January 31 to February 1, nearly all of its individuals agreed that it’s obligatory to boost the rate of interest by 0.25%, which is in keeping with the expectations of buyers and merchants. Nevertheless, the detrimental second was the knowledge that a number of individuals of the assembly had been in favor of elevating the rate of interest by 0.5%, and thus this might result in larger borrowing prices and, in consequence, result in a slowdown in financial development. One of many doable causes for the need of some members of the FOMC to tighten financial coverage and thereby elevate the important thing fee by 50 foundation factors could also be the truth that the tempo of slowing inflation is declining and, in consequence, it’s essential to act extra aggressively to attain the inflation goal at 2%. So, the annual inflation fee in the US was 6.41% as of January 31, 2023, which is simply 0.04% lower than the earlier month.

Supply: YCharts

If the Fed raises the rate of interest by 0.5%, then this may strengthen the US greenback and enhance funding curiosity in US Treasuries (US10Y) (US2Y) in comparison with Bitcoin, which is attempting to get out of the bearish cycle.

Conclusion

After a fourteen-month bear market that introduced frustration and apathy to varied digital property on the a part of crypto group members, the primary important indicators of its restoration lastly appeared on the horizon.

Throughout the bearish interval, there was a redistribution of Bitcoin possession from buyers who’re much less disciplined and fewer assured within the asset to those that clearly perceive the worth of cryptocurrencies in a quickly evolving digital world. In latest weeks, there was a major enhance within the variety of transactions, which positively affected miners’ earnings. In Q1 2023, two key gamers within the crypto trade, Riot Platforms (RIOT) and Hut 8 Mining (HUT) introduced a rise in Bitcoin mining. Given the elevated worth of cryptocurrencies and the rise within the variety of mining tools, it may be stated with excessive confidence that the biggest Bitcoin mining corporations have efficiently handed the take a look at of the energy of their monetary place from Mr. Market.

In line with a report by Constancy Digital Belongings, a subsidiary of Constancy Investments, European and American institutional buyers have reported an enchancment within the notion of cryptocurrencies and proceed to extend funding in numerous digital property. In my estimation, in 2023, there might be a tightening of regulation by numerous authorities companies, which, on the one hand, will scale back the urge for food of speculative merchants within the quick time period, however then again, will entice the eye of long-term and extra conservative buyers. So, for instance, in keeping with the optimistic forecast of ARK Make investments, the worth of Bitcoin can attain $1.48 million by 2030, however with a extra conservative estimate, Katie Wooden’s firm (ARKK) can attain the worth of the preferred cryptocurrency within the quantity of $258,500, which is considerably larger than the present values. As well as, many institutional market individuals proceed to scale back curiosity in commodity mastodons comparable to Exxon Mobil (XOM), Occidental Petroleum (OXY), and Chevron Company (CVX) and start to extend their urge for food for riskier property.

In conclusion, I wish to word that in keeping with my mannequin, within the subsequent two weeks, I anticipate a correction within the worth of Bitcoin because of the strengthening of the US greenback in opposition to different currencies through the Fed’s rate of interest hike and in addition the tightening of tensions between the administration of US President Joe Biden and the Chinese language authorities. After that, the buildup part might come, which I’ll use to purchase shares in Bitcoin mining corporations and ETFs concerned in managing digital property.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.