Early Friday stock-index futures buying and selling point out the S&P 500 will begin the session a number of factors above the 5,000 mark.

Breaching — and shutting above — massive spherical numbers in fairness indices inevitably encourages optimists to hope that what was thought of resistance can turn into help.

It could possibly additionally produce reflections on how the previous might give a clue to what comes subsequent. Julian Emanuel, strategist at Evercore ISI, sees a similarity between the Y2K inventory market surge of the late 1990’s and at present’s market, although he acknowledges the usual caveat: historical past seldom repeats however usually rhymes.

“The unrelenting momentum that has carried the S&P 500 to the spherical variety of 5,000 has few equals in historical past, the standout instance being the web fueled rally off an analogous market backside in October 1998 versus the pivotal October 2022 low,” says Emanuel in a observe despatched to shoppers this week.

To recall, the Y2K phenomenon occurred through the nascent dot-com increase, when some expertise shares received additional propulsion from expectations corporations would spend gazillions making certain their pc techniques might swap to 2000 when the brand new millennium started. Do we’ve an analogous frenzy concerning AI?

Right here’s Emanuel’s chart displaying the S&P 500’s trajectory from these October lows he’s citing. If the rhyming is wealthy then at present’s market might battle to make rather more headway on this cycle.

Supply: Evercore ISI

Emanuel is fast to notice the variations. As we speak’s valuations could also be stretched at 22 instances trailing twelve month earnings, however that’s nicely under the 28 instances seen on the Y2K/dot-com bubble high.

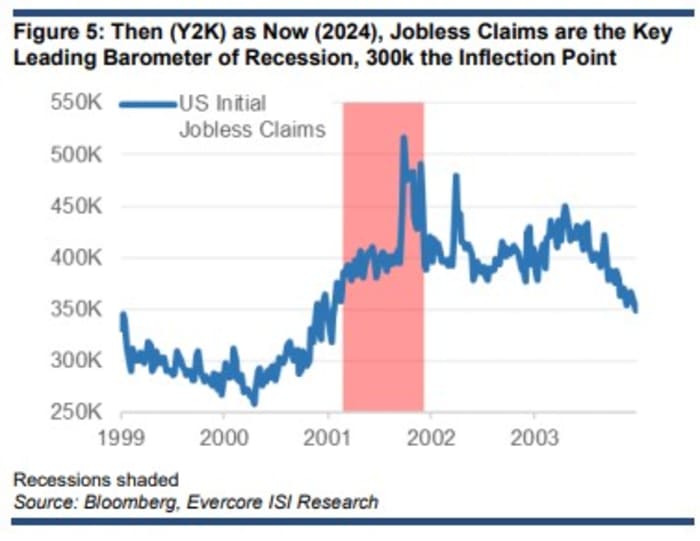

And after the Y2K/dot-com bubble burst in early 2,000 there was a spike in weekly preliminary jobless profit claims a full yr forward of the 2001 recession. Present unemployment claims of round 210,000 and stoic shopper confidence information suggests little signal of such stress simply but.

Supply: Evercore ISI

Nevertheless, he’s nonetheless nervous by the similarities between at times. “The worth parallels, the constructive feeling round the long run potential of generative AI and traders’ new discovered confidence that cash may be made in shares – because it was in 1999 – regardless of a ten yr Treasury yield solidly affixed to 4%+, continues to reveal equities to inflation, earnings and Fed coverage disappointments,” says Emanuel.

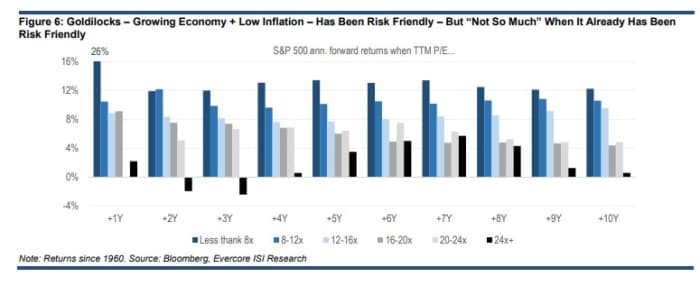

Certainly, he thinks the market’s current ‘Goldilocks’ valuation paradigm is according to ahead common inventory returns of zero p.c, no matter whether or not a recession is averted or not.

Supply Evercore ISI

Consequently he favors protection. “We preserve our yr finish S&P 500 value goal of 4,750 and reiterate our choice for communications providers, shopper staples, and well being care, sectors which have traditionally outperformed within the time from the Fed’s final hike to the primary fee reduce,” says Emanuel.

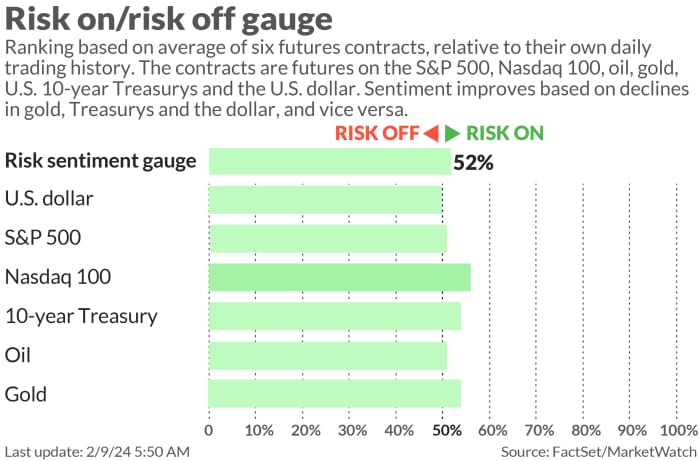

Markets

U.S. stock-index futures

ES00

YM00

NQ00

have been firmer early Friday as benchmark Treasury yields

nudge greater. The U.S. greenback

was little modified, whereas oil costs

CL

dipped and gold

GC00

traded round $2,030 an oz..

| Key asset efficiency | Final | 5d | 1m | YTD | 1y |

| S&P 500 | 4,997.91 | 0.79% | 4.48% | 4.78% | 22.18% |

| Nasdaq Composite | 15,793.71 | 1.05% | 5.48% | 5.21% | 34.78% |

| 10 yr Treasury | 4.168 | 14.48 | 22.38 | 28.66 | 42.98 |

| Gold | 2,046.60 | -0.51% | -0.34% | -1.22% | 9.07% |

| Oil | 76.32 | 5.41% | 4.89% | 7.00% | -4.31% |

| Information: MarketWatch. Treasury yields change expressed in foundation factors | |||||

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Each day.

The excitement

A revision to the U.S. shopper value index’s seasonal components will probably be revealed at 8:30 a.m. Jap. “These revisions, if they’re giant and to the upside, might blow the case for reducing charges,” says Kathleen Brooks, analyst at XTB.

Dallas Fed President Lorie Logan is because of converse at 1:30 p.m. ET.

There are some massive premarket strikes for shares of corporations that reported after Thursday’s shut. Traders favored what Cloudflare

NET

needed to say and its inventory is up 25%. However numbers and statements from Expedia

EXPE,

down 14%, Affirm

AFRM,

off 11%, and Pinterest

PINS,

falling 11%, have been poorly obtained.

Corporations reporting earnings earlier than the opening bell rings on Wall Avenue embody PepsiCo

PEP,

Plains All American Pipeline

PAA

and Enbridge

ENB.

China’s markets at the moment are closed for per week to have fun Lunar New 12 months.

Better of the net

The spectacular crash of a $30 billion property empire.

$3 for a single McDonald’s hash brown? Clients are fed up and pushing again.

The chart

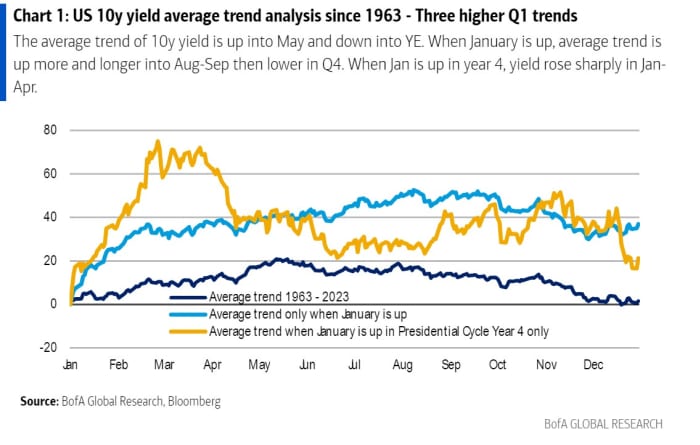

Many traders can have heard of the January impact concerning shares: {that a} sturdy first month usually means an excellent yr as a complete. Effectively, in line with Paul Ciana, technical strategist at BofA Securities, an analogous factor happens for the 10-year Treasury yield. He’s crunched the numbers going again to 1963 and because the chart under exhibits, when the benchmark yield is up in January the development from February by way of year-end was greater 61% of the time by +81 foundation factors on common.

High tickers

Right here have been probably the most lively stock-market tickers on MarketWatch as of 6 a.m. Jap.

| Ticker | Safety title |

| TSLA | Tesla |

| NVDA | Nvidia |

| PLTR | Palantir Applied sciences |

| ARM | Arm Holdings |

| MARA | Marathon Digital |

| TSM | Taiwan Semiconductor Manufacturing ADR |

| AAPL | Apple |

| AMC | AMC Leisure |

| NIO | NIO ADR |

| GME | GameStop |

Random reads

‘My AI boyfriend Is boring me to dying’.

Chernobyl’s cancer-resilient mutant wolves.

Turning the air blue. The subsequent stage in ruining soccer.

American CEOs visiting China can’t escape it: they’ve to bounce on stage.

Must Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model will probably be despatched out at about 7:30 a.m. Jap.

Try On Watch by MarketWatch, a weekly podcast in regards to the monetary information we’re all watching. This episode: The beginning of the AI increase, and one of many Tremendous Bowl’s sweetest stars. Earnings season has Huge Tech speaking about generative AI. However will chatbots turn into massive enterprise? Plus, we nerd out over the sweet relic that went from $50 million to $500 million in annual gross sales.