Shares of Lowe’s Firms, Inc. (NYSE: LOW) had been down over 1% on Thursday. The inventory has dropped 5% over the previous three months. The corporate is slated to report its fourth quarter 2022 earnings outcomes on Wednesday, March 1. Right here’s a have a look at what to anticipate from the upcoming earnings report:

Income

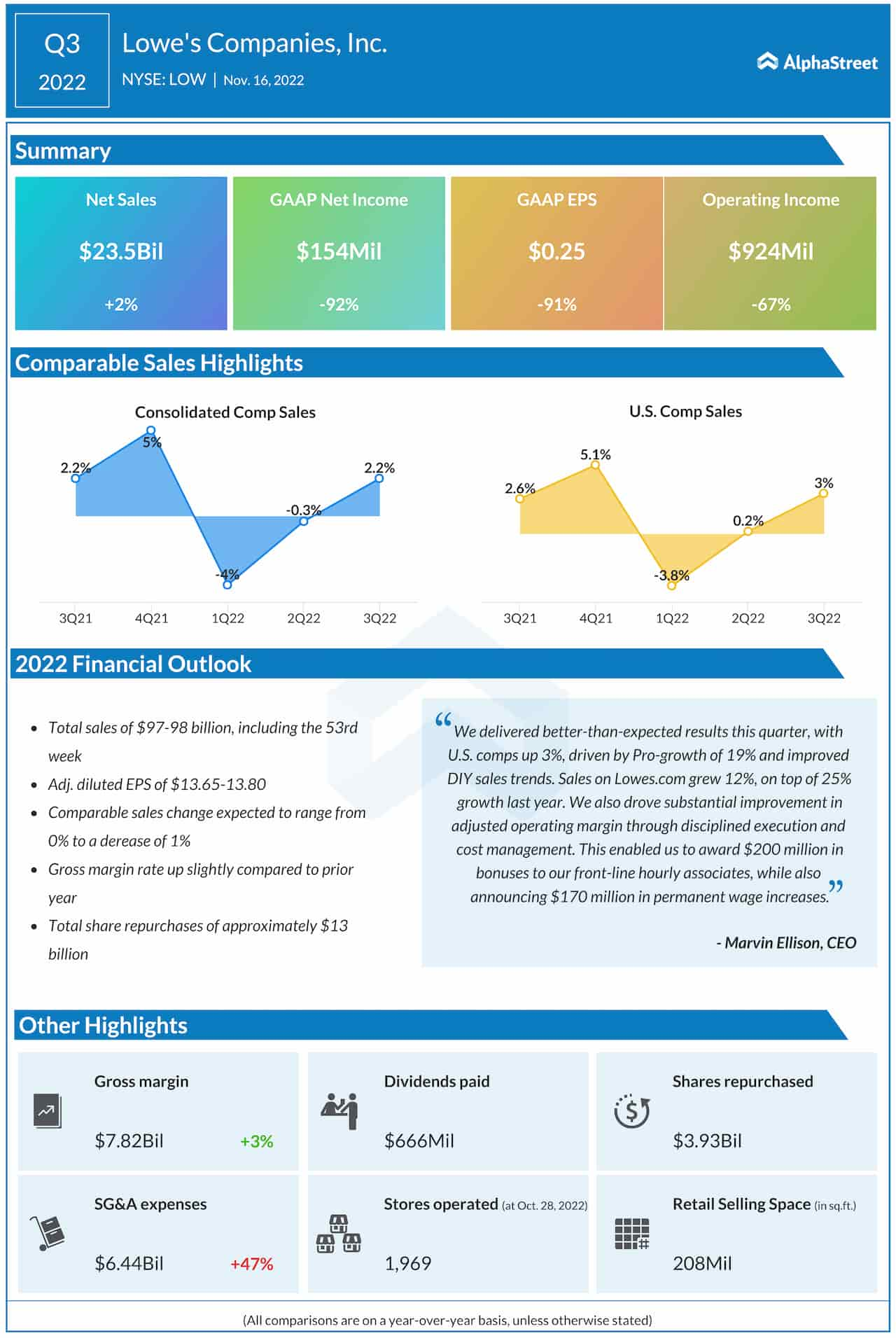

Analysts are projecting income of $22.7 billion for Lowe’s in This fall 2022. This compares to complete gross sales of $21.3 billion reported within the fourth quarter of 2021 and $23.5 billion reported within the third quarter of 2022.

Earnings

The consensus goal for EPS in This fall 2022 is $2.21 which compares to adjusted EPS of $1.78 reported in This fall 2021. In Q3 2022, adjusted EPS rose almost 20% year-over-year to $3.27.

Factors to notice

On its third quarter convention name, Lowe’s maintained an optimistic outlook on the prospects of the house enchancment market. Nonetheless, the most recent earnings report from its rival House Depot (NYSE: HD), which was launched this week, paints a special image. House Depot’s internet gross sales in This fall 2022 didn’t see a lot progress from the year-ago interval and the corporate forecasted a moderation in demand for house enchancment in 2023.

On its Q3 name, Lowe’s had talked about that the common age of properties within the US is over 40 years previous and this was a key motive why a big a part of house enchancment concerned restore or upkeep initiatives that might not be delayed thereby making it a non-discretionary spend. The retailer additionally stated that over 70% of its Professional prospects anticipated to get extra work in 2023 than 2022. In its This fall report, House Depot additionally acknowledged that its Professional backlogs stay excessive in comparison with historic averages. So it’s doubtless that Lowe’s may have benefited from this pattern in its fourth quarter.

In Q3, Lowe’s witnessed broad-based progress throughout Professional and DIY within the millwork, tough plumbing, electrical, lumber and constructing supplies divisions. Constructing merchandise benefited from energy within the DIY class as lumber costs got here down and prospects picked up house enchancment initiatives they’d postpone earlier. In This fall, House Depot recorded constructive comps in departments like constructing supplies, plumbing, and outside backyard.

House Depot expects to see flat shopper spending in 2023 and it has hinted at the potential for a decline within the house enchancment market. It stays to be seen whether or not Lowe’s will observe in its peer’s footsteps or whether or not it stands to realize in its personal proper.

Additionally learn: House Depot (HD): Three elements that don’t work in favor of this house enchancment retailer